Saturday Feb 14, 2026

Saturday Feb 14, 2026

Friday, 17 February 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

All bids received for the four Treasury bond auctions conducted yesterday were rejected, the reason for which was probably bids at higher yields by market participants.

Given below are the details of the auction.

In the secondary bond market, yields were seen increasing further on moderate trading. Selling interest during the morning hours saw yields increase of the 15.11.18, 01.07.19 and the two 2021 maturities (i.e. 01.05.21 and 01.08.21) to intraday highs of 11.80%, 12.10% and 12.60% each respectively, against its previous day’s closing levels of 11.52/70, 12.00/15, 12.53/62 and 12.50/60. However, activity dried up subsequent to the auction results.

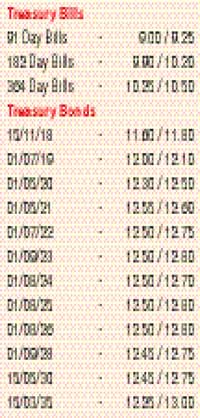

Given below are the closing, secondary market yields for the most frequently traded T-bills and bonds.

In money markets, the overnight call money and repo rates averaged 8.45% and 8.60% respectively as the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen infusing liquidity for the first time since 24 November 2016 by way of a reverse repo auction. An amount of Rs. 20 billion was infused at a weighted average of 8.48%. The deficit in money markets was seen increasing further to Rs. 23.16 billion.

In Forex markets, the USD/LKR rate on active two-week and one-month forward contracts depreciated yesterday to lows of Rs. 151.55/65 and Rs. 152.00/15 respectively against its previous day’s closing levels of Rs. 151.20/25 and Rs. 151.65/70 on the back of continued importer demand.

The total USD/LKR traded volume for 14 February was $ 166.15 million.

Given below are some forward USD/LKR rates that prevailed in the market.

Three months - 153.60/00

Six months - 156.25/40