Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 15 September 2015 01:43 - - {{hitsCtrl.values.hits}}

Bond yields broadly steady ahead of auctions

By Wealth Trust Securities

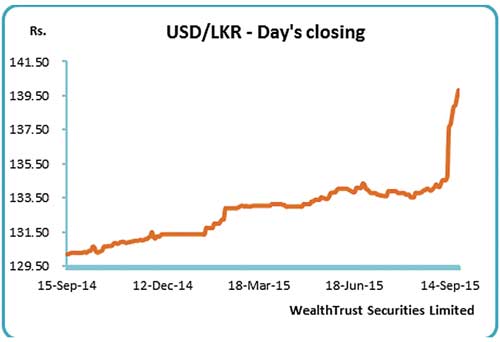

In forex markets, the USD/LKR rate on spot contracts dipped to an all-time low of Rs. 139.95 yesterday, closing in on the psychological level of Rs. 140.00 on the back of continued importer demand but bounced back marginally to close the day at Rs. 139.80/85.

In secondary bond markets, selling interest during the morning hours of trading saw yields on the 01.05.2020, 01.07.2022 and 01.09.2023 maturities edge up to daily highs of 9.55%, 9.90% and 10.00% respectively.

However, buying interest at these levels curtailed any further upward movement as yields dipped marginally once again to opening lows of 9.45%, 9.85% and 9.95%. In addition, a limited amount of activity was witnessed on the 01.08.2025 maturity as well within the range of 10.26% to 10.30%. This was ahead of today’s bond auctions, where Rs. 16 billion in total will be on offer consisting of Rs. 3 billion each on a 4.07-year maturity of 01.05.2020 and a 12.11-year maturity of 01.09.2028 and a further Rs. 5 billion each on a 7.00-year maturity of 01.10.2022 and a 9.10-year maturity of 01.08.2025.

The previously concluded bond auctions on 8 September saw the 4.07-year maturity of 01.05.2020 record a weighted average of 9.65%, reflecting an increase of 30 basis points (bp) while the 8.00 year maturity of 01.09.2023 reflected an increase of 49 bp to 10.25%. The 14.08-year maturity of 15.05.2030 recorded a weighted average of 10.96% while all bids for the 10.09-year maturity of 01.06.2026 were rejected.

In money markets, surplus liquidity remained high at Rs. 82.84 billion as overnight call money and repo rates remained steady to average 6.35% and 6.39% respectively. The total USD/LKR traded volume for 11 September 2015 was $ 56.25 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 140.60/80; three months - 141.60/90 and six months - 143.50/00.