Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 14 January 2016 00:00 - - {{hitsCtrl.values.hits}}

Reuters: The rupee ended slightly weaker on Wednesday as importer dollar demand outpaced greenback sales by banks and exporters, dealers said.

Reuters: The rupee ended slightly weaker on Wednesday as importer dollar demand outpaced greenback sales by banks and exporters, dealers said.

However, a few dealers anticipate that the rupee will appreciate due to expected dollar deposits from foreign investors.

The rupee ended at 143.80/90 per dollar, slightly weaker from Tuesday’s close of 143.75/85.

“The rupee is weaker as exporters were not there in the market due to global and local uncertainties. Hence, they were holding on to the dollars without selling it,” said a currency dealer, requesting not to be named.

“Today the demand (for dollars) was more. Everybody is expecting the said inflows,” he added.

The market expects the depreciation pressure on the rupee to ease due to a rise in commercial banks’ statutory reserve ratio by 150 basis points from 16 January, which is in line with the Central Bank’s monetary policy announcement last month.

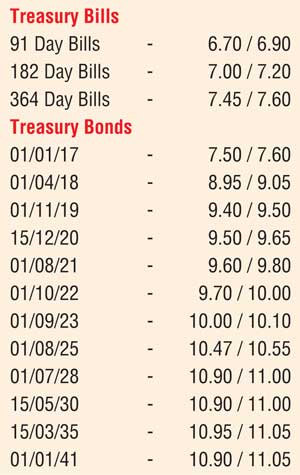

The yield in 91-day t-bills rose 19 basis points to a three-month high of 6.78% at the weekly auction on Tuesday.

Commercial banks parked Rs. 87.739 billion ($610.15 million) of surplus liquidity on Wednesday using the Central Bank’s deposit facility at 6%, while they borrowed Rs. 0.843 billion through the Central Bank’s lending facility at 7.5%, official data showed.