Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 5 August 2016 00:00 - - {{hitsCtrl.values.hits}}

Reuters: The rupee ended firmer on Thursday as foreign investors sold dollars to buy local bonds on hopes of higher returns after the Central Bank’s policy rate hike, dealers said.

The spot rupee, which was last actively traded on 13 June, resumed trading on Thursday. It traded at 145.60/68 per dollar, compared with Wednesday’s indicative price of 145.80/90, a dealer said.

“There was a lot of foreign buying in local bonds. The spot currency is being actively traded today,” said a currency dealer, asking not to be named.

“Foreign investors have been buying bonds since the IMF (International Monetary Fund) loan was approved and we see some sudden increase after the appointment of the new Central Bank Governor and last week’s policy rate hike.”

Dealers also said foreign investors were also converting dollars to buy equities.

The spot rupee is usually managed tightly by the Central Bank, and market participants use the forward market levels for guidance on the currency.

One-week rupee forwards ended at 145.80/88 per dollar, up from Wednesday’s close of 146.00/15.

The Central Bank last week raised its main interest rates by 50 basis points each in a surprise move aimed at curbing stubbornly high credit growth that is adding to concerns about inflationary pressures.

Foreign investors have bought Rs. 64.5 billion ($443.30 million) worth of Government securities, since the IMF agreed to a $1.5-billion bailout package, from 29 April through 27 July, Central Bank data showed.

By Wealth Trust Securities

By Wealth Trust Securities

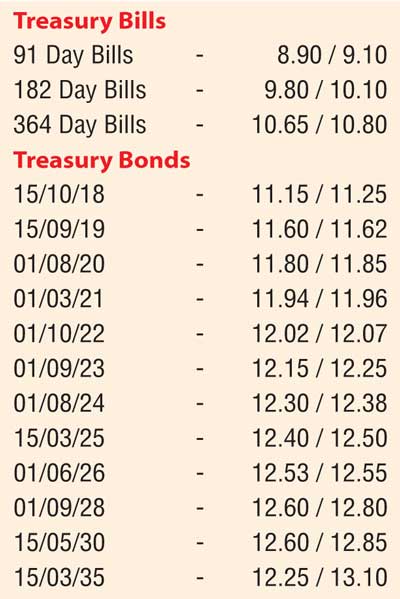

The secondary bond market witnessed a further dip in yields yesterday on the back of moderate volumes, mainly on the liquid maturities of 15.09.19, 01.03.21, 01.09.23, 01.08.24 and 01.08.26 to hit intraday lows of 11.60%, 11.93%, 12.20%, 12.35% and 12.62% respectively against its previous days closings of 11.63/65, 11.95/99, 12.25/33 and 12.65/70. In addition, 2018 maturities were seen changing hands within the range of 11.15% to 11.25% as well.

Meanwhile in money markets, the injection of liquidity by way of an overnight reverse repo auction amounting to Rs.45.00 billion at a weighted average rate of 8.29% by the Open Market Operations (OMO) Department of the Central Bank resulted in the weighted averages of overnight call money and repo rates remaining steady at 8.40% and 8.54% respectively. The liquidity in the system stood at a net deficit of Rs.43.68 billion.

Rupee appreciates

Meanwhile in Forex markets, the rupee on the one week forward contract appreciated yesterday to close the day at Rs.145.70/75 against its previous day’s closing levels of Rs.146.00/10, while spot contracts were seen actively quoted at levels of Rs.145.60/65 after a lapse of close to two month. The spot next contracts were quoted at levels of Rs.145.65/68. The total USD/LKR traded volume for 3 August was $ 67.26 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 146.50/60; three months – 148.20/40; and six months – 150.50/70.