Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 21 December 2016 00:00 - - {{hitsCtrl.values.hits}}

Reuters: The rupee closed weaker on Tuesday on dollar buying by banks and importers, with dealers saying the rupee was expected to fall further unless the country’s Central Bank stepped in to raise interest rates.

The dollar bounced back towards 14-year highs on Tuesday, boosted by upbeat comments by US Federal Reserve Chair Janet Yellen that kept alive market expectations for a faster pace of US interest rate hikes next year than had previously been forecast.

At home, rupee forwards were active with spot-next forwards closing at 149.85/95 per dollar, compared with Monday’s close of 149.60/80.

“There is some element of uncertainty after a stock deal was reversed. Some banks are collecting dollars. Sentiment has to be built up for inflows,” a currency dealer said, asking not to be named.

On Monday, Sri Lankan Prime Minister Ranil Wickremesinghe ordered a reversal and a probe into a Rs. 1.3 billion ($ 8.7 million) stake sale deal in Seylan Bank, and dealers said that dented market sentiment.

The spot-next was quoted at 149.90/150.10 before a bank offered dollars at 149.90 to ease pressure on the rupee, dealers said.

The Central Bank will have to let the currency depreciate or raise key policy rates at a monetary board meeting later this month, they said.Finance Minister Ravi Karunanayake told Reuters in an interview on Tuesday that the currency would recover and be steady next year with expected foreign inflows.

The spot currency was hardly traded on Tuesday.

The Central Bank increased the spot reference rate by 30 cents to 149.10 after the US Federal Reserve raised interest rates by 25 basis points last Wednesday. It raised the reference rate by a total 40 cents last week.

The rupee usually rises in December ahead of Christmas and New Year due to remittances from expatriates, but dealers said the currency was expected to face pressure this time due to higher dollar demand from importers following the Fed rate hike.

Analysts say they expect some capital outflow as an immediate reaction to the Fed rate hike, and have expressed concern that the Government’s foreign borrowing cost would rise in the short term.

Foreign investors have net sold Rs. 52.3 billion ($ 350.77 million) of government securities in the eight weeks ended 14 December.

By Wealth Trust Securities

Overall activity in secondary bond markets remained dull ahead of today’s Treasury bill auction. However, due to foreign selling pressure, limited amounts of the 15.10.21 maturity traded at highs of 12.30% to 12.40%.

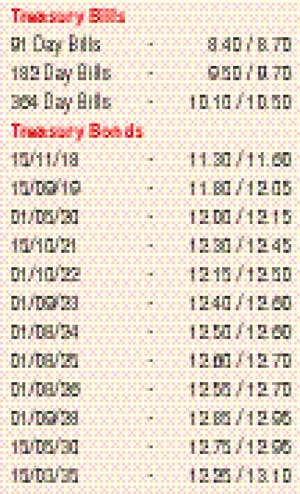

Meanwhile, today’s weekly bill auction will have on offer a total amount of Rs. 29.5 billion, consisting of Rs. 7.5 billion of the 91-day maturity, Rs. 12.0 billion of the 182-day maturity and a further Rs. 10 billion of the 364-day maturity. At last week’s auction, the weighted average of the 364-day maturity increased by 01 basis point to 10.11% while the weighted average of the 182-day bill remained steady at 9.56%. Meanwhile, all bids received for the 91-day maturity, were rejected, with the total accepted amount falling short of the total offered amount for a 11th consecutive week.

In money markets, the overnight repo rate increased marginally to average 8.58% as liquidity reversed to a net shortfall of Rs. 1.48 billion. The overnight call money rate remained steady at 8.42%.

Rupee losses further

The USD/LKR rate on spot next contracts was seen picking up to intraday highs of Rs. 149.90 against its previous day’s closing level of Rs. 149.65/75, prior to activity shifting towards one week forward contracts at levels of Rs. 150.25/45.

The total USD/LKR traded volume for 19 November 2016 was $ 80.04 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 150.85/05; three months - 152.35/55 and six months - 154.80/00.