Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 15 September 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

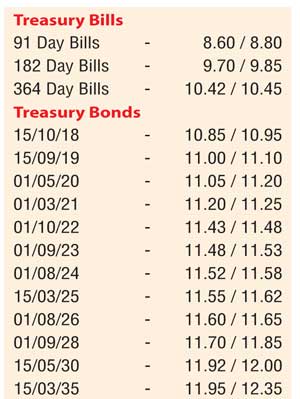

The secondary bond market continued to remain active yesterday, with the upward trend in rates witnessed throughout the previous days persisting as yields picked up during the morning hours of trading. The liquid maturities of 15.09.19, 01.03.21, 01.10.22, 01.08.24 and 01.08.26 were seen hitting intraday highs of 11.20%, 11.32%, 11.57%, 11.65% and 11.76% respectively against its previous day’s closing levels of 11.01/05, 11.06/10, 11.35/45, 11.58/63 and 11.65/72.

However, buying interest towards the later part of the day saw yields dipping once again to hit lows of 11.00%, 11.20%, 11.45%, 11.55% and 11.65% respectively. Furthermore, maturities of 01.09.23 and 01.01.24 were seen trading between highs of 11.64% each and lows of 11.50% and 11.60% respectively.

Meanwhile in money markets, the overnight Repo rate averaged 8.62% as the OMO (Open Market Operations) Department of the Central Bank of Sri Lanka injected an amount of Rs.20.00 billion on an overnight basis at a weighted average rate of 8.49%. The overnight Call money rate remained steady at 8.40%.

Rupee losses further

In Forex markets, the rupee on spot contracts deprecated further to close the day at Rs.145.55/70 against its previous day’s closing levels of Rs.145.38/42 on the back of continued importer demand.

The total USD/LKR traded volume for 13 September 2016 was $ 122.78 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 146.50/60; 3 Months - 148.05/40 and 6 Months - 150.55/80.