Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 15 August 2016 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

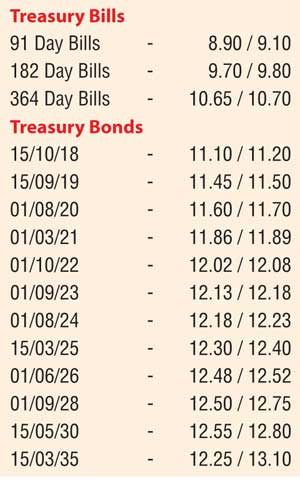

The secondary bond market was seen closing the week ending 12 August on a steady note as activity across the yield curve was witnessed within a tight range. An equilibrium situation in the market was seen as the reason behind this as the liquid maturities of 15.09.19, 01.03.21, 01.09.23, the two 2024’s (i.e. 01.01.24 and 01.08.24) and the two 2026’s (i.e. 01.06.26 and 01.08.26) were seen trading within a range of 11.45% to 11.53%, 11.85% to 11.90%, 12.10% to 12.15%, 12.15% to 12.25% and 12.45% to 12.51% respectively against its previous weeks closing levels of 11.47/50, 11.86/90, 12.10/19, 12.15/25 and 12.43/50.

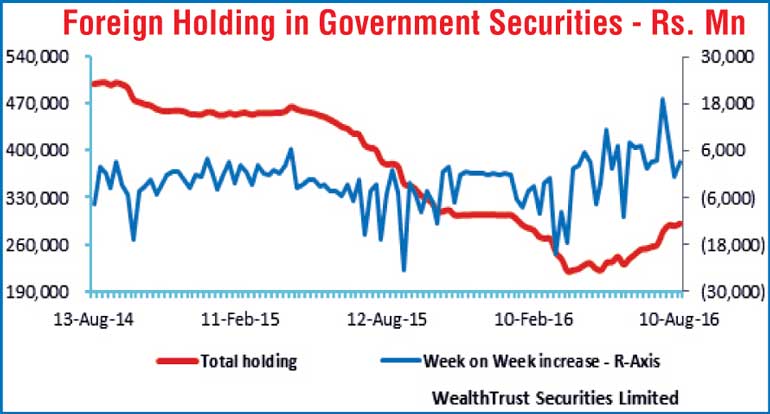

The weekly Treasury bill auction reflected the same sentiment as well, with the weighted averages on the 91 day and 182 day maturities increasing by two basis points each while the weighted average on the 364 day maturity dipped by one basis point. The total foreign holding in Rupee bonds for the week ending 10 August was seen recording an inflow once again to the tune of 3.2 billion, reversing an outflow witnessed over the previous week.

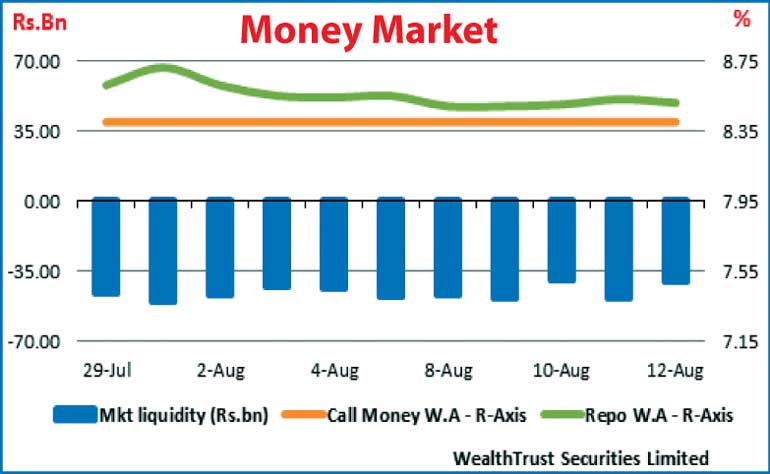

In money markets, despite the average net liquidity shortage in the system remaining at Rs. 44.74 billion for the week, the overnight call money and repo rates remained mostly unchanged to average at 8.40% and 8.49% respectively as the OMO (Open Market Operation) department of Central Bank injected liquidity throughout the week at weighted averages ranging from 8.30% to 8.33% on an overnight basis.

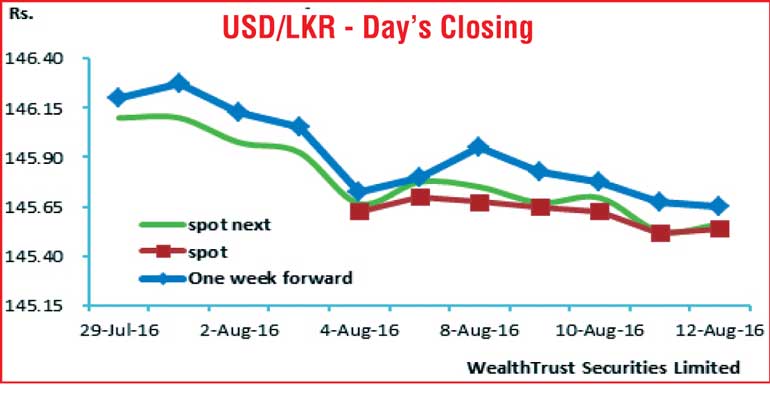

Rupee appreciates further during the week

The rupee on spot, spot next and one week forward contracts appreciated further during the week to close the week at Rs. 150.50/58, Rs. 150.54/58 and Rs. 145.60/70 respectively against its previous weeks closing levels of Rs. 145/65/75, Rs. 145.70/85 and Rs. 145.75/85 on the back of foreign buying in rupee bonds along with export conversions outweighing importer demand. The daily USD/LKR average traded volume for the first four days of the week stood at $ 58.13 million.

Some of forward dollar rates that prevailed in the market were one month – 146.40/60; three months – 148.10/30 and six months – 150.40/60.