Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 3 April 2017 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

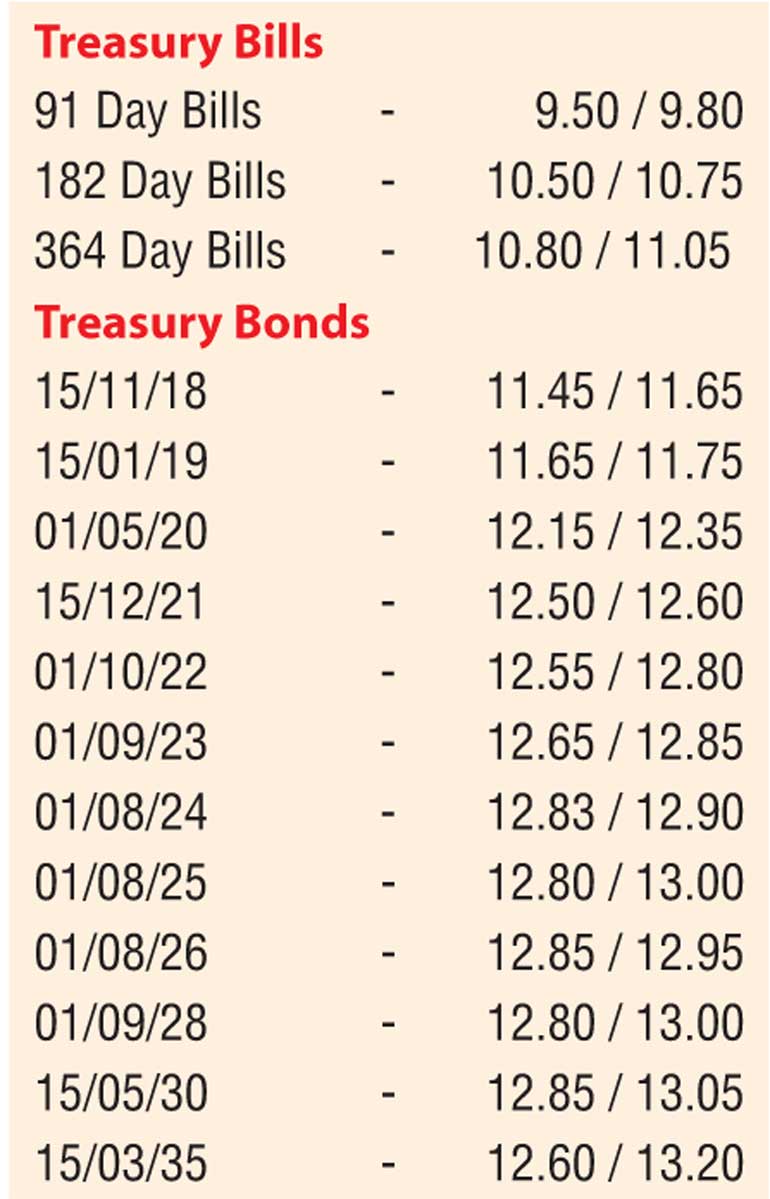

During the week ending 31 March, the secondary bond market experienced considerable volatility, with yields decreasing during the early part of the week, prior to picking up subsequently. Yields of the liquid maturities of 15.12.21, the two 2024s (i.e. 01.01.24 and 01.08.24) and 01.08.26, dropped to weekly lows of 12.47%, 12.70% each and 12.72% respectively.

However, following the outcome of the weekly Treasury bill auction, where the weighted averages increased across all three maturities, selling pressure returned to the market, driving yields up, touching weekly highs of 12.59%, 12.88% and 12.85% each respectively, of the said maturities.

Furthermore, maturities of 01.06.18, 15.01.19, 01.07.19, 01.08.21 and 01.06.26 were traded within the range of 11.18% to 11.25%, 11.60% to 11.92%, 11.83% to 11.96%, 12.45% to 12.56% and 12.80% to 12.87%.

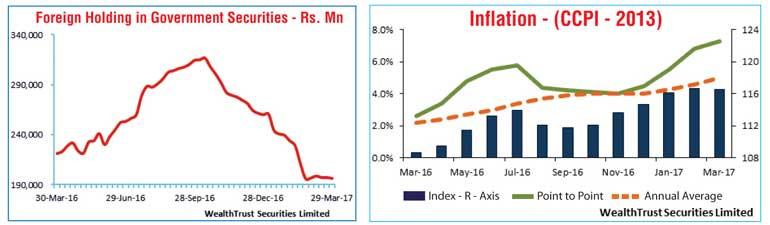

Meantime, the inflation figure for the month of March reflected a further increase for the third consecutive month, to 7.3% and 5.00% respectively on the point to point and Annual Average, when compared against the previous month’s figures of 6.8% and 4.6%. Furthermore, the foreign holding in Sri Lankan Rupee bonds recorded an outflow once again to the value of Rs.950 million during the week ending 29 March. The daily secondary market Treasury bond transacted volume for the first four days of the week averaged Rs. 7.02 billion.

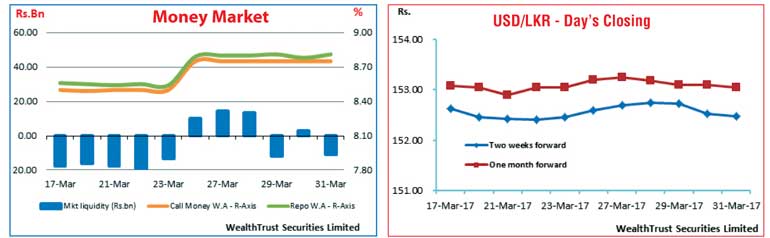

In money markets, liquidity was seen reducing towards the latter part of the week as the OMO Department of the Central Bank of Sri Lanka was seen conducting overnight Reverse Repo auctions in order to infuse liquidity at a weighted average ranging from 8.73% to 8.74% against overnight repo auctions conducted during the early part of the week at 7.73% to 7.75%. The overnight call money and repo rates averaged 8.75% and 8.80% respectively during the week ending 31 March.

Rupee appreciates during the week

The USD/LKR rate appreciated marginally during the week to close the week at levels of Rs. 152.40/55 against its previous weeks closing level of Rs. 152.55/65 on the back of export conversions outweighing seasonal importer demand.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 41.93 million.

Some of the forward dollar rates that prevailed in the market were one month – 153.00/10; three months – 155.05/15 and six months – 158.00/20.