Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 25 April 2016 00:00 - - {{hitsCtrl.values.hits}}

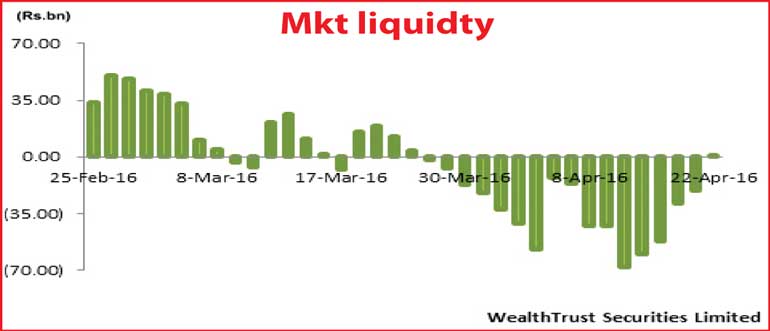

Liquidity turns positive for the first time in four weeks

Liquidity turns positive for the first time in four weeks

By Wealth Trust Securities

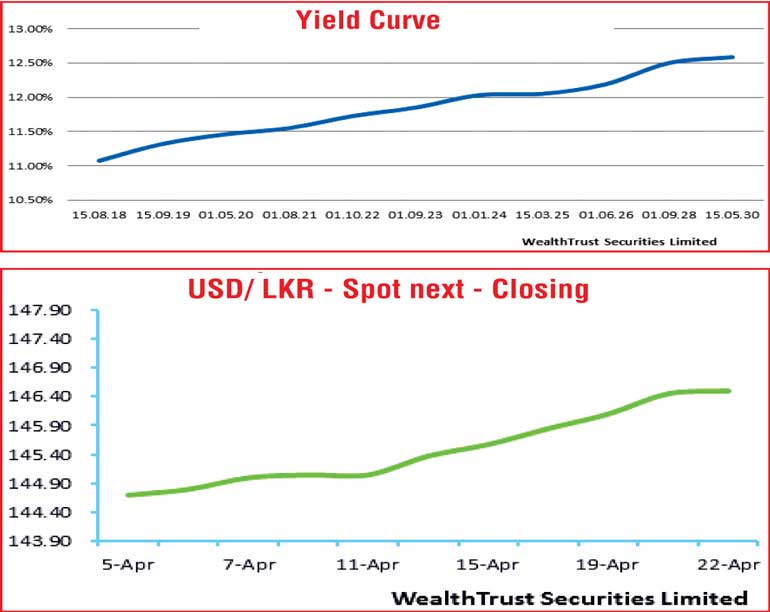

The secondary bond market witnessed a week of volatility as yields were seen continuing its decreasing trend during the first half of the week ending 22 April, on the back of the rejection of all bids at the Treasury bond auctions, despite sizable demand. Yields on the liquid maturities of 01.05.20, 01.08.21, 01.01.24, 15.03.25, 01.01.26 01.09.28 and 15.05.30 was seen decreasing to lows of 11.30%, 11.45%, 11.95%, 11.99%, 12.18%, 12.40% and 12.47% respectively.

However, following the outcome of weekly Treasury bills auction, at where the weighted average on the 364 day bill increased for the first time in three weeks, yields were seen reversing its downward trend and increased once again to hit highs of 11.60% each, 12.05%, 12.08%, 12.25%, 12.50% and 12.70% on the back selling interest on profit taking.

Nevertheless the sentiment in markets remained positive toward the later part of week as yield were seen dipping marginally once again on the back of fresh local and foreign buying interest. In money markets, the daily injected amount by the Open Market Operations (OMO) department of Central Bank dipped down to Rs. 5 billion on Friday as net liquidity turned positive for the first time in four weeks on Friday against its previous week’s average deficit of Rs. 56.54 billion. The overnight call money and repo rates decreased marginally during the week to average 8.15% and 8.09% respectively.

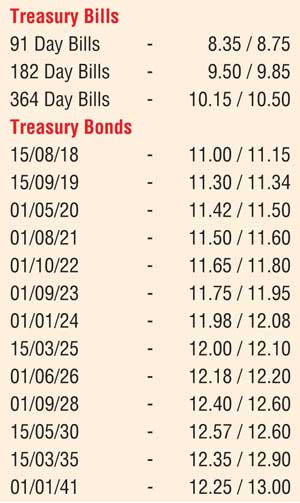

Rupee depreciates further during the week

The rupee on spot next contracts closed the week lower at Rs. 146.30/70 in comparison to its previous weeks closing levels of Rs. 145.40/75 on the back of continued demand for the green back. The daily USD/LKR average traded volume for the first three days of the week stood at $ 54.52 million.

Some of the forward dollar rates that prevailed in the market were one month – 147.10/30; three months – 149.00/30 and six months – 151.30/60.