Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 6 October 2015 00:03 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

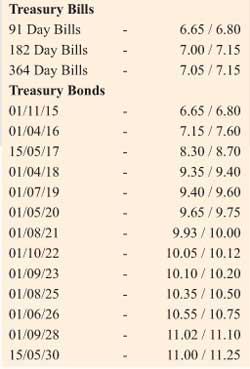

In secondary market bonds, yields were seen closing the day broadly steady yesterday amidst thin trades.

The limited amount of activity was witnessed on the liquid maturities of 1 May 2018, 1 May 2020, 1 August 2021 and 1 October 2022 within the range of 9.38% to 9.40%, 9.65% to 9.68%, 9.95% to 9.96% and 10.05% to 10.07% respectively while yields on the rest of the yield curve remained steady.

Meanwhile in money markets, surplus liquidity stood at Rs. 61.23 billion as overnight call money and repo rates averaged 6.35% and  6.49% respectively yesterday.

6.49% respectively yesterday.

Rupee steady

In Forex markets, the USD/LKR rate stood steady to close the day at Rs. 141.24/30 against previous trading day’s closing levels of Rs.141.23/25. The total USD/LKR traded volume for 2 October was $ 52.24 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 141.85/95; three months – 143.05/15; six months – 144.60/70.