Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 29 June 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

The yields in the secondary bond market continued to decline for a second consecutive day on the back of local and foreign buying interest following the impressive outcome of the Treasury bond auctions conducted on Monday.

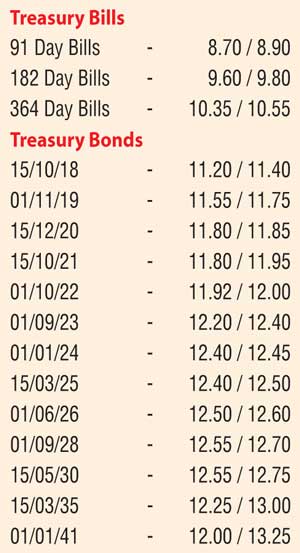

The yields on the liquid maturities of 15.12.20, 01.10.22, 01.01.24, 15.03.25 and 01.06.26 were seen declining to intraday lows of 11.78%, 11.94%, 12.34%, 12.40% and 12.45% respectively against its opening highs of 11.85%, 12.10%, 12.40%, 12.50% and 12.55%. However, the announcement of three further Treasury bond auctions for Thursday, 3 July curtailed the downward movement.

This was ahead of today’s weekly Treasury bill auction, at where a total amount of Rs.22 billion will be on offer, the lowest offered amount in 12 weeks, which will consist of Rs.8.5 billion each on the 91 day and 182 day maturities and Rs.5 billion on the 364 day maturity. At last week’s auction, weighted averages increased for a sixth consecutive week to 8.86%, 9.83% and 10.55% respectively.

In secondary bill markets, October 2016 bills were quoted at levels of 8.95/20 while April and June 2017 were traded within the range of 10.10/30 and 10.35/45 respectively.

Meanwhile in money markets yesterday, the injection of an amount of Rs.20 billion by the Open Market Operations (OMO) department of Central Bank on an overnight basis at a weighted average of 7.97% saw overnight call money and repo rates remain steady to average 8.18% and 8.06% respectively. The net liquidity shortage in the market stood at Rs.20.14 billion.

Rupee appreciates again

The USD/LKR rate on the active one week forward contract was seen appreciating once again yesterday to close the day at Rs.147.95/10 against its previous day’s closing of Rs.148.30/50 as export conversions were seen outweighing importer demand. The total USD/LKR traded volume for 27 June was $ 90.00 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 148.50/60; three months – 150.05/20; and six months – 152.20/30.