Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 18 May 2016 00:07 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

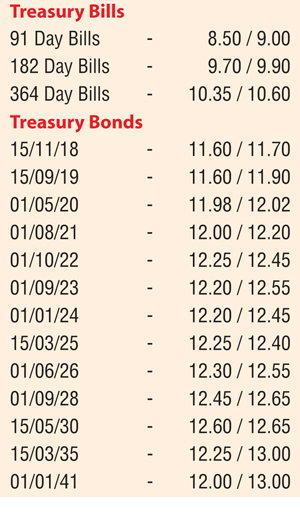

The upward momentum in secondary market bond yields continued for a third consecutive day, mainly on the short end of the yield curve yesterday. Selling interest in morning hours of trading saw yields edge up to 12.10% and 11.65% on the 01.05.2020 and 15.11.2018 maturities against its days opening lows of 12.00% and 11.60% on the back of considerable volumes changing hands. In addition, the maturities of 01.05.2021 and 01.10.2022 were seen changing hands within the range of 12.05% to 12.15% and 12.25% to 12.30% as well. On the long end of the yield curve, the 15.05.2030 maturity was seen changing hands within a tight range of 12.60% to 12.62%. This was ahead of four Treasury bond auctions totaling Rs. 45 billion due on Thursday in line with a Rs. 87 billion bond and coupon maturity due on the 1 June. Furthermore the Central Bank of Sri Lanka’s monitory policy announcement for the month of May is scheduled for 20 May at 5.00 pm.

Meanwhile at today’s weekly bill auction, a total amount of Rs.30 billion will be on offer consisting of Rs.10 billion each on the 91 day 182 day and 364 day maturities. At last week’s auction, the weighted average on the 364 day maturity increased for a second consecutive week to 10.37% while the weighted average on the 182 day bill recorded a surprise dip of 23 basis points to 9.40%. Meanwhile all bids received on the 91 day bill were rejected.

In money markets yesterday, the overnight call money and repo rates remained mostly unchanged to average 8.15% and 8.00% respectively as market liquidity remained at a net surplus of Rs.4.683 billion.

Rupee remains

broadly steady

The USD/LKR rate on the active spot next contract remained mostly unchanged to close the day at Rs.Rs.146.65/90 as markets were at equilibrium. The total USD/LKR traded volume for 16 May was US $ 42.10 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 147.40/55; 3 Months - 149.10/30 and 6 Months - 151.35/50.