Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 23 June 2015 00:13 - - {{hitsCtrl.values.hits}}

By Courtesy Wealth Trust Securities

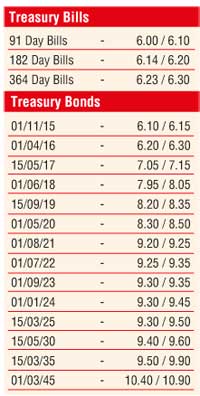

The upward trend in secondary market Treasury bond yields continued yesterday as well on the back of continued selling interest on the liquid maturities of 1 August 2021, 1 July 2022 and 1 September 2023, reflecting increases of 40 basis points each and 30 basis points respectively during the day to intraday highs of 9.25%, 9.30% and 9.32% respectively in comparison to its previous day’s closing levels of 8.80/87, 9.00/05 and 9.08/20 as volumes traded  remained high.

remained high.

This was ahead of today’s Treasury bond auctions, at where Rs. 2 billion will be on offer consisting of Rs. 1 billion each on a two-year maturity of 15 June 2017 and a 3.05 year maturity of 15 November 2018.

Meanwhile in money markets, overnight call money and repo rates remained steady to average 6.10% and 5.78% respectively as surplus liquidity remained steady at Rs. 65.41 b yesterday.

Rupee gain grounds

The USD/LKR rate on spot contracts appreciated yesterday by 20 cents to close the day at Rs. 133.90 against its previous day’s closing level of Rs. 134.10. The total USD/LKR traded volume for 19 June was $ 62.30 million.