Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 13 May 2015 00:59 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

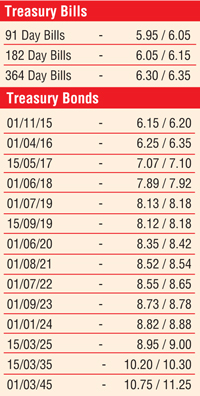

Activity in the secondary bond markets remained high yesterday as yields were seen decreasing in the morning hours of trading mainly on the shorter duration maturities of 01.06.2018, 01.07.2019 and 15.09.2019 to intraday lows of 7.88%, 8.08% and 8.04% respectively.

|

However, subsequent to the release of the Treasury bond auction results, yields were seen increasing marginally once again on the back of profit-taking. In addition, a limited amount of activity was witnessed on the 15.05.2017 maturity within the range of 7.08% to 7.12%, the 01.08.2021 within 8.50% to 8.55%, the 01.09.2023 within 8.74% to 8.77% and the 15.03.2025 within 8.95% to 8.98%. At yesterday’s bond auction, the 4.01-year maturity of 01.07.2019 fetched a weighted average of 8.15% while all bids for the 6.02-year maturity of 01.08.2021 were rejected.

In secondary bill markets, November 2015 bills were quoted at levels of 6.05% to 6.15% and the 364-day bill was at 6.30% to 6.35%. This was ahead of today’s weekly Treasury bills auction, where a total of Rs. 26 billion will be on offer consisting of Rs. 4 billion on the 91-day, Rs. 7 billion on the 182-day Rs. 15 billion on the 364-day maturities. At last week’s auction, weighted averages dipped across the board to hit a ten week low of 6.12%, 6.26% and 6.35% respectively.

In money markets, the high surplus liquidity of Rs. 120.53 billion saw overnight call money and repo rates remain steady to average 6.11% and 6.03% respectively yesterday.

Rupee on spot contracts dip

The rupee on spot contracts was seen dipping to a low of Rs. 133.50 yesterday. However, the one-month and two-month forward contracts were seen closing mostly unchanged at levels of Rs. 134.70/90 and Rs. 135.65/75 respectively.

Some of the forward dollar rates that prevailed in the market were 3 months - 136.30/50 and 6 months - 137.95/15