Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 17 May 2016 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

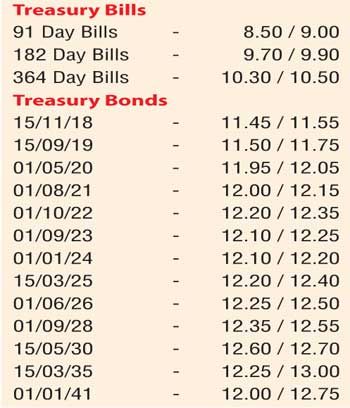

The selling interests in bond markets continued for a second consecutive day as yields were seen increasing across the curve. The yields on the short end of the curve, comprising of the maturities of 15.11.2018 and 01.05.2020 were seen moving up to daily highs of 11.50% and 11.95% respectively against its opening lows of 11.40% and 11.78%, while on the long end of the curve, the 15.05.2030 maturity edged up to a daily high of 12.60% against an opening low of 12.50% on the back of thin volumes changing hands. In  addition, a limited amount of activity was witnessed on the 01.01.2024 maturity within the range of 12.05% to 12.15% as well.

addition, a limited amount of activity was witnessed on the 01.01.2024 maturity within the range of 12.05% to 12.15% as well.

In money markets yesterday, the overnight call money and repo rates remained mostly unchanged to average 8.15% and 8.00% respectively as the net surplus liquidity in the system stood at Rs.4.04 billion.

Rupee continues to slide further

The USD/LKR rate on the active spot next contract depreciated further to close the day at Rs.146.80/95 against its previous trading day’s closing level of Rs.146.40/45 on the back of importer demand. The total USD/LKR traded volume for 13 May was US $ 68.85 million.

Some f the forward USD/LKR rates that prevailed in the market were 1 Month - 147.65/90; 3 Months - 149.15/35 and 6 Months - 151.45/60.