Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 25 June 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market continued to remain active as yields declined for a second consecutive day on the back of continued buying interest.

Buying interest on liquid maturities of 01.06.2018, 15.09.2019, 01.05.2020, 01.08.2021, 01.09.2023 and 15.03.2025 saw its yields dip to intraday lows of 7.65%, 8.03%, 8.25%, 8.82%, 9.11% and 9.20% respectively against its days opening highs of 7.70%, 8.10%, 8.35%, 8.95%, 9.20% and 9.25%.

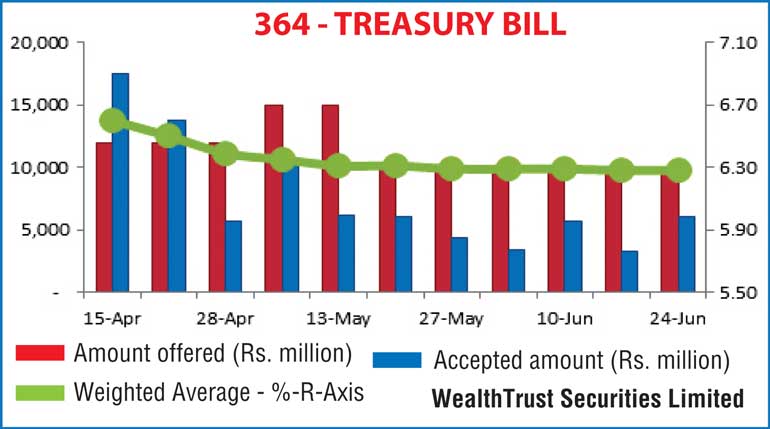

Meanwhile, at today’s weekly Treasury bill auction, all three weighted averages held steady as the total accepted amount was seen falling short of the total accepted amount for the first time in three weeks. The shortfall in the accepted amount was Rs. 7.30 billion against its total offered amount of Rs. 22 billion with the 182-day bill representing 47.8% of this amount.

Meanwhile, in money markets, overnight call money and repo rates remained steady to average 6.10% and 5.82% respectively despite surplus liquidity decreasing further to Rs. 59.73 billion yesterday.

Rupee appreciates

The USD/LKR rate on spot contracts appreciated further yesterday by 10 cents to close the day at Rs. 133.80 against its previous day’s closing level of Rs. 133.90. The total USD/LKR traded volume for the 23 June was $ 48.10 million.

Some of the forward dollar rates that prevailed in the market were 3 months - 135.40/50 and 6 months - 136.95/10.

(Reuters): Shares ended steady on Wednesday, hovering near a one-week high, as losses in banking and telecommunication stocks offset gains in large-caps in moderate trade due to political uncertainty ahead of the announcement of parliamentary polls.

The main stock index ended 0.13 points weaker at 7,053.83, slipping from its highest close since 18 June hit on Tuesday.

Turnover stood at Rs. 606.35 million ($ 4.5 million), well below this year’s daily average of about Rs. 1.1 billion.

“Not many people buying or no selling. Investors are just waiting till the elections are announced,” said Dimantha Mathew, a research manager at First Capital Equities Ltd.

Dialog Axiata Plc fell 1.82%, while Nestle Lanka Plc rose 3.32% and Ceylon Tobacco Co Plc ended up 1.07%.

The market saw net foreign outflows of Rs. 64 million on Wednesday, extending net foreign outflows in the past 21 sessions to Rs. 3.5 billion in stocks.

The Bourse, however, has seen net inflows of Rs. 2.47 billion into equities so far in 2015.

Investors were confused due to a lack of direction on interest rates, economic policies, and on the timing of the parliamentary election, analysts said.

President Maithripala Sirisena’s Government has said he would dissolve the parliament once some crucial reforms, including an electoral bill, are passed, but is yet to fix a date for the election.