Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 4 September 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market saw yields declining yesterday following two continuous days of increases on news of the balance $ 1.1 billion swap agreement with the Reserve Bank of India (RBI) and the Central Bank of Sri Lanka (CBSL) taking effect today.

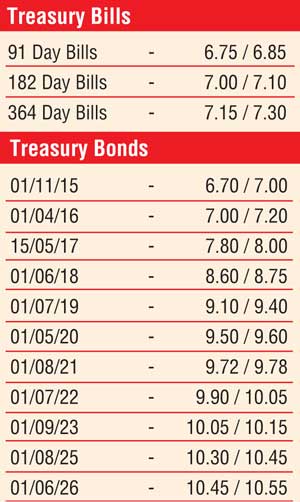

Buying interest on the 1 May 2020, 1 August 2021 and 1 September 2023 maturities saw its yields decline to daily lows of 9.50%, 9.70% and 10.00% respectively against its previous day’s closing levels of 9.73/79, 9.82/90 and 10.20/25.

Meanwhile in secondary bill markets, durations centring two to three months were traded within the range of 6.65% to 6.80%.

Meanwhile in money markets, overnight call money and repo rates increased further to average 6.34% and 6.50% respectively despite the Open Market Operations (OMO) department of Central Bank injecting an amount of Rs. 5.03 b on an overnight basis at a weighted average rate of 6.30% and surplus liquidity in markets, increasing further to Rs. 45.94 yesterday.

Rupee depreciates once gain

Meanwhile in Forex markets, the rupee lost ground yesterday to close the day at levels of Rs.134.75 against previous day’s closing levels of Rs.134.50. The total USD/LKR traded volume for 2 September was $ 89.65 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 135.35/45; three months – 136.57/67; six months – 138.39/49.