Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 8 July 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

In the secondary bond market yesterday, foreign and local buying interest saw yields dip across the curve. On the short end of the yield curve, 2018, 2019, 2020 and 2021 maturities were seen dipping to intraday lows of 11.25%, 11.55%, 11.70% and 11.90% respectively against its days opening highs of 11.35%, 11.60%, 11.75% and 11.95% while on the belly end of the curve, the 01.01.24, 15.03.25 and 01.06.26 maturities were seen dipping to lows of 12.30%, 12.45% and 12.49% respectively against its opening highs of 12.50%, 12.63% and 12.68%. Meanwhile on the long end of the curve, the 01.09.28 and 15.05.30 maturities were seen changing hands within the range of 12.75% to 12.80% and 12.78% to 12.82% respectively as well.

This was ahead of today’s Treasury bond auction, where a total amount of Rs. 35 billion will be on offer consisting of four maturities. The 3.02 year maturity of 15.09.2019 will have on offer Rs. 10 billion while the 4.08 year maturity of 01.03.2021 and the 6.03 year maturity of 01.10.2022 will have Rs. 9 billion each on offer with a further Rs. 7 billion on offer on a 7.02 year maturity of 01.09.2023.

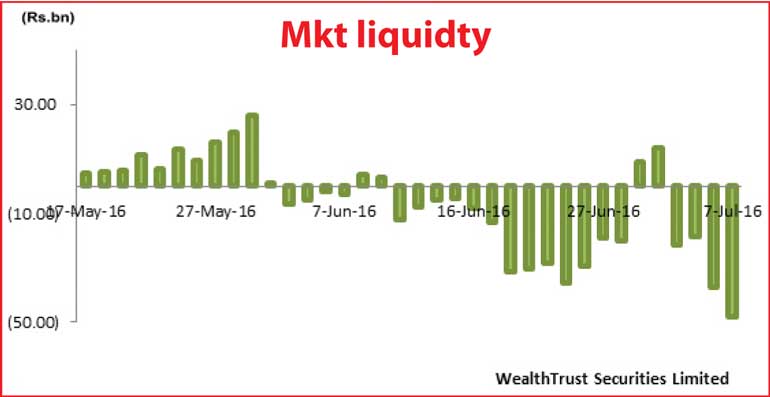

In money markets, call money and repo rates remained steady despite the net shortfall in the system increasing to over a eleven week high Rs 48.01 billion yesterday. This was mainly due to the OMO department of the Central Bank pumping in an amount of Rs. 45 billion on an overnight basis by way of a reverse repo auction at a weighted average rate of 7.99%.

Rupee gains to a three week high

In Forex markets, foreign buying in Rupee bond coupled with export conversions were seen outweighing importer demand, leading to the USD/LKR rate on its one week forward contract appreciating to a three week high of Rs. 146.00/20 yesterday against its Tuesday’s close of Rs. 147.10/30. The total USD/LKR traded volume for 5 July was $ 60.95 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 146.70/00; 3 Months - 148.30/80 and 6 Months - 150.30/70.