Thursday Feb 26, 2026

Thursday Feb 26, 2026

Tuesday, 12 July 2016 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

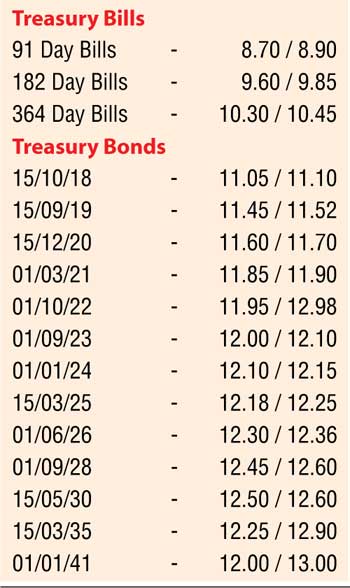

The launch of a sovereign dollar bond issue by the Central Bank of Sri Lanka on behalf of the government of Sri Lanka for tenures of 5 and 10 years with a price guidance of 6.125% and 7.125% yesterday saw secondary market bond yields dip, mainly on the belly end  of the long end of the yield curve. Buying interest in morning hours of trading saw yields on the 01.01.24, 15.03.25 and 01.06.26 maturities dip to intraday lows of 12.05%, 12.18% and 12.27% respectively while on the short end of the curve, the 15.11.18, 15.09.19, 01.03.21 and 01.10.22 maturities dipped to lows of 11.00%, 11.48%, 11.78% and 11.90% respectively on the back of foreign and local buying. However the announcement of a round of bond auctions totaling Rs. 23 billion saw yields edge up once again to its opening highs.

of the long end of the yield curve. Buying interest in morning hours of trading saw yields on the 01.01.24, 15.03.25 and 01.06.26 maturities dip to intraday lows of 12.05%, 12.18% and 12.27% respectively while on the short end of the curve, the 15.11.18, 15.09.19, 01.03.21 and 01.10.22 maturities dipped to lows of 11.00%, 11.48%, 11.78% and 11.90% respectively on the back of foreign and local buying. However the announcement of a round of bond auctions totaling Rs. 23 billion saw yields edge up once again to its opening highs.

In money markets, call money and repo rates remained steady to average at 8.20% and 8.07% respectively yesterday as the OMO department of Central Bank was seen pumping in an amount of Rs. 50 billion on an overnight basis by way of a reverse repo auction at a weighted average rate of 7.98%.

In Forex markets, the USD/LKR rate on its active one week forward contracts were seen depreciating yesterday to close the day at Rs. 146.20/30 against its previous day’s closing levels of Rs. 145.95/20. The total USD/LKR traded volume for 8 July was $ 56.50 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 146.60/00; 3 Months - 148.15/40 and 6 Months - 150.35/60.