Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 15 June 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary market bond yields dipped marginally yesterday following two days of increases on the back of renewed buying interest.

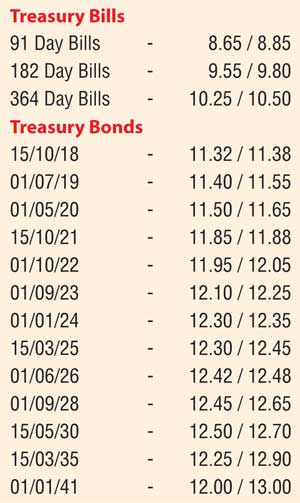

Foreign and local buying interest on the liquid maturities of 15.10.2018, 15.10.21, 01.01.24 and 01.06.26 saw its yields dip to intraday lows of 11.36%, 11.84%, 12.30% and 12.43% respectively against its days opening highs of 11.40%, 11.88%, 12.33% and 12.45%.

In addition on the short end of the curve, 2017 bond maturities were seen changing hands within the range of 10.43% to 10.47%.

This was ahead of today’s weekly Treasury bill auction at where a total amount of Rs.30 billion will be on offer, consisting of Rs.11 billion each on the 91 day and 182 day maturities and a further Rs.8 billion on the 364 day maturity.

At last week’s auction, weighted averages on all three maturities increased by 2 basis points (bp) and 01 bp each 8.82%, 9.76% and 10.53% respectively. In the secondary bill market, duration centering the 91 day bill was quoted at levels of 8.65/85 and the 182 day at 9.55/80.

Meanwhile in money markets, the overnight call money and repo rates remained mostly unchanged to average at 8.17% and 8.06% respectively as the Open Market Operations (OMO) Department of Central Bank injected an amount for Rs.5 billion at a weighted average rate of 8.00% on an overnight basis.

Rupee dips marginally

The USD/LKR rate on its spot and spot next contract was seen dipping marginally yesterday to close the day at Rs.144.80/00 and Rs.144.90/10 against its previous day’s closing of Rs.144.70/85 and Rs145.75/90 on the back of importer demand outweighing foreign buying in Rupee bonds and export conversions.

The total USD/LKR traded volume for 13 June was $ 113.45 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 145.65/75; three months – 147.30/50; six months – 149.50/70.