Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 7 July 2015 01:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

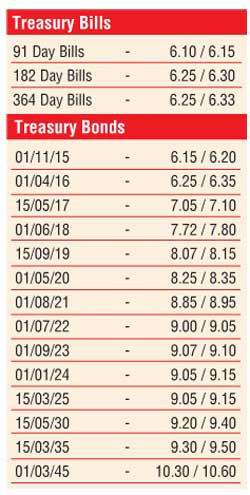

The secondary bond market witnessed a day of thin trading yesterday as buying interest on the 01.09.2023 and 15.03.2025 maturities saw its yields dip marginally to intraday lows of 9.05% and 9.10% respectively.

This led to two-way quotes on the rest of the yield curve to remain muted as well.

Overnight call money and repo rates remained steady to average 6.12% and 5.89% respectively as surplus liquidity in money markets remained at Rs. 67.55 bn yesterday.

Rupee remains steady

In Forex markets, the USD/LKR rate on spot contracts remained steady to close the day at Rs. 133.60. The total USD/LKR traded volume for 3 July 2015 was $ 32.01 million.

Some of the forward dollar rates that prevailed in the market were 3 Months - 135.20/25 and 6 Months - 136.75/90.

Rupee steady; forwards tad weaker

Reuters: The rupee ended steady on Monday in dull trade as a State-run bank sold dollars at 133.60 to keep the currency flat while the forwards ended slightly weaker as importer dollar demand surpassed inward remittances, dealers said. |