Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 21 April 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

Buying interest mainly from local participants, and an increase in market liquidity, resulted in the secondary market bond yields declining yesterday.

The liquid maturity of 01.01.24 saw its yield decline to a daily low of 12.48% in comparison to the previous day’s closing levels of 12.60/68.

Furthermore, activity was also witnessed of the 01.11.19 maturity, two 2021 maturities (i.e. 01.05.21 and 15.12.21) and 01.08.24 maturity within the range of 11.83% to 11.85%, 12.25%, 12.18% to 12.20% and 12.51% to 12.52% respectively, against the previous day’s closing levels of 11.95/05, 12.25/35, 12.20/25 and 12.65/75. This in turn resulted in the overall yield curve shifting downwards for the first time in seven days.

The total secondary market Treasury bond transacted volume for the 19 April was at Rs.5.45 billion.

In the money market, the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen draining out an amount of Rs.47.00 billion on an overnight basis at a weighted average of 7.40% by way of an overnight repo auction as the net surplus liquidity in the system increased to a over two and half months high of Rs.48.45 billion. The overnight call money and repo rates remained at an average of 8.75% each.

The rupee on two week forward contracts was seen appreciating yesterday to close the day at Rs.153.20/30 against its previous day’s closing levels of 153.45/50 on the back of export conversions outweighing importer demand.

The total USD/LKR traded volume for 19 April was $ 61.65 million.

Some of forward USD/LKR rates that prevailed in the market were one month – 153.70/85; three months – 156.05/20; and six months – 159.10/25.

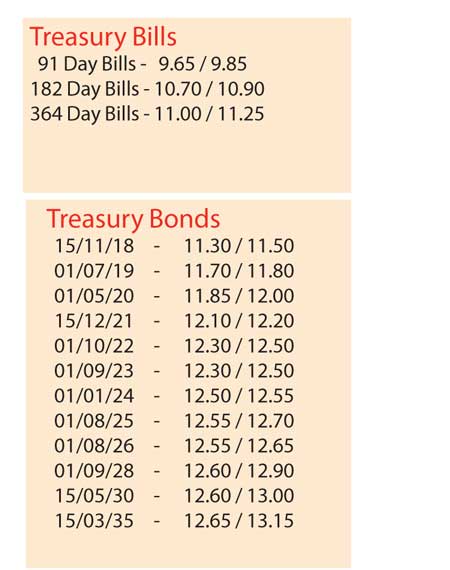

The closing, secondary market yields for the most frequently traded T – bills and bonds,