Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 31 March 2017 04:12 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The decreasing trend in secondary market bond yields witnessed during the last few days changed yesterday, with yields edging up,  mainly along the belly end of the yield curve.

mainly along the belly end of the yield curve.

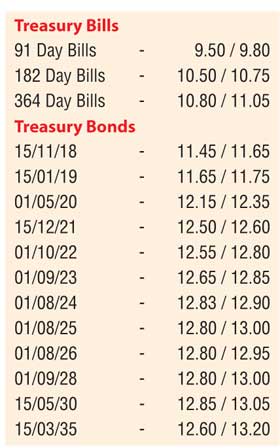

The liquid maturities of 01.01.24, 01.08.24 and 01.08.26 were seen hitting intraday highs of 12.85%, 12.88% and 12.85% respectively against its previous day’s closing levels of 12.70/80, 12.75/80 and 12.75/80.

Furthermore, maturities consisting of 01.04.18, 01.06.18, 01.08.21 and 15.12.21 were seen edging up as well to hit highs of 11.05%, 11.25%, 12.56% and 12.59%.

This was ahead of today’s inflation announcement for March. Inflation for February increased to 6.8% on the point to point while its annual average increased to a high of 4.6%.

Meanwhile, in money markets, the Central Bank of Sri Lanka refrained from conducting any auctions under its Open Market Operations (OMO) as net market liquidity stood at Rs. 2.7 billion. The overnight call money and repo rates remained mostly unchanged to average 8.75% and 8.78% respectively.

The USD/LKR rate on active two week forward contracts were seen appreciating for the first time in five days to close the day at levels of Rs. 152.45/60 against its previous day’s closing level of Rs. 152.65/80.

The total USD/LKR traded volume for 29 March 2017 was $ 50.05 million.

Some of the forward USD/LKR rates that prevailed in the market were three months - 155.20/40 and six months - 158.25/50.