Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 22 September 2015 00:16 - - {{hitsCtrl.values.hits}}

“Wait-and-see” policy by market participants following IMF report

By Wealth Trust Securities

Activity in secondary bond markets moderated yesterday as yields were seen edging up marginally in thin trade due to uncertainties prevailing on the outcome of Septembers monitory policy announcement due on Friday, following the International Monetary Fund (IMF) staff report.

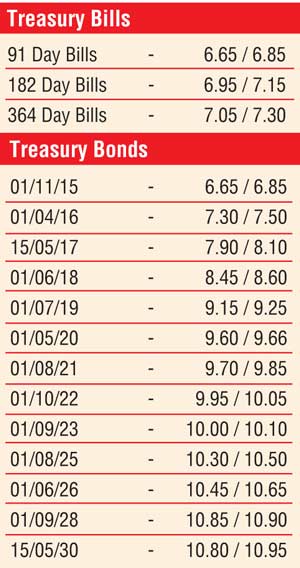

Selling interest on the liquid maturities of 1 July 2019, 1 May 2020 and 1 September 2023 saw its yields increase to intraday highs of 9.20%, 9.60% and 10.05% respectively against its days opening lows of 9.15%, 9.52% and 10.00%.

This was ahead of today’s weekly Treasury bill auction, conducted one day ahead due to the shortened trading week, at where an total amount of Rs. 22 billion will be on offer consisting of Rs. 4 b on the 91 day, Rs. 7 b on the 182 day and Rs. 11 b on the 364 day maturities respectively. At last week’s auction, weighted averages remained unchanged on the 91 day and 364 day maturities at 6.79% and 7.17% respectively while all bids received for the 182 day maturity was rejected.

In money markets, overnight call money and repo rates remained mostly unchanged to average 6.35% and 6.49% respectively as surplus liquidity stood at Rs.75.82 billion yesterday.

Rupee resumes downward trend

The rupee on spot contracts was seen depreciating once gain to hit an intraday low of Rs.140.85 against its previous day’s closing level of 140.50/60 on the back of import demand outweighing export conversions. The total USD/LKR traded volume for the 18th of September 2015 was $ 33.51 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 141.43/50; three months – 142.60/80 and six months – 144.20/40.