Friday Mar 06, 2026

Friday Mar 06, 2026

Monday, 10 July 2017 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

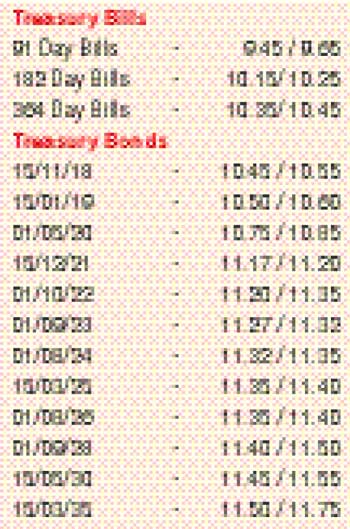

The secondary bond market remained active as yields were seen see sawing during the week ending 7 July. Continued local and foreign buying during the early part of the week saw yields declining across the yield curve on the back of considerable volumes changing hands. The outcome of the weekly Treasury bill auction was seen supplementing the dip in yields as weighted averages were seen resuming its downward trend after a lapse of one week.

The liquid maturities of the two 2021s (01.08.21 and 15.12.21), 01.09.23, 01.08.24 and the two 2026s (01.06.26 and 01.08.26) saw its yields dip to intraweek lows of 11.12% each, 11.25%, 11.27%, 11.35% and 11.30% respectively. However selling interest and profit taking towards the latter part of the week saw yields increasing once again to its weeks opening highs of 11.22% each, 11.31%, 11.35%, 11.45% and 11.40%. Furthermore, the foreign holding in Rupee bonds was seen turning negative for the first time in nine weeks, as it reflected an outflow of Rs. 2.1 billion for the week ending 5 July. The daily secondary market Treasury bond transacted volume for the first four days of the week averaged Rs. 8.04 billion. In money markets, liquidity was seen improving during the week to average a net deficit of Rs. 8.97 billion against its previous week’s net deficit average of Rs. 38.36 billion. The Open Market Operations (OMO) department of Central Bank infused liquidity during the week apart from Tuesday at a weighted average of 8.75%. Call money and repo remained steady to average 8.75% and 8.79% respectively.

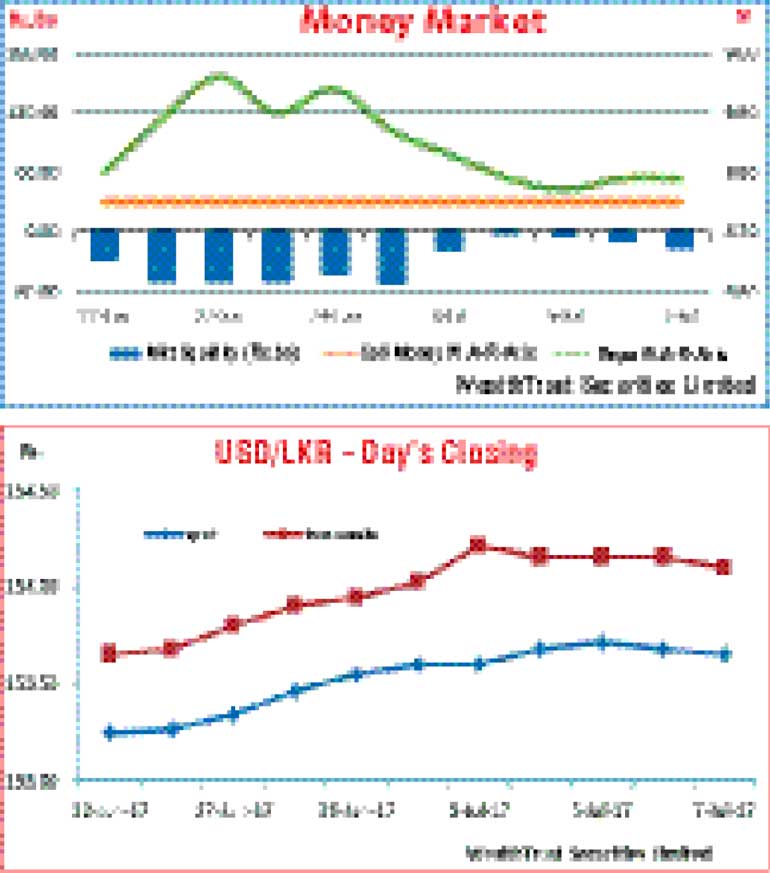

Rupee continues depreciating trend

The Rupee on its spot contracts were seen dipping to an intraweek low of Rs. 153.75 on Wednesday but recovering towards the end of the week to close the week at Rs. 153.60/70 against its previous weeks closing of Rs. 153.50/60.

The daily USD/LKR average traded volume for the three days of the week stood at $ 45.98 million.

Given are some forward dollar rates that prevailed in the market: one month – 154.60/70; three months – 156.60/70; six months – 159.45.