Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 11 May 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Secondary market bond yields were seen increasing yesterday on the back of profit taking and selling interest ahead of today’s weekly Treasury bill auction.

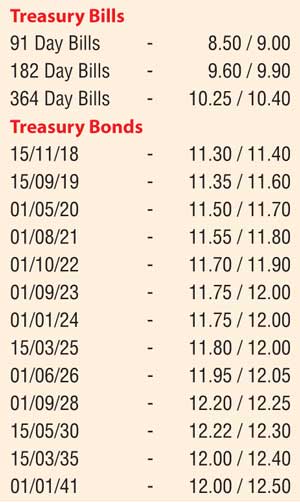

The maturities of 15.11.18, 01.06.26 and 15.05.30 were the more actively traded durations as it was seen hitting intraday highs of 11.35%, 12.00% and 12.30% respectively against its days opening lows of 11.27%, 11.98% and 12.20%.

In addition, two way quotes on the rest of the yield curve were seen increasing as well. This was ahead of today’s weekly Treasury bill auction, at where a total amount of Rs.30 billion will be on offer consisting of Rs.12 billion each on the 182 day and 364 day maturities and a further Rs.6 billion on the 91 day maturity. At last week’s auction, weighted averages increased across the board to record 8.52%, 9.63% and 10.27% respectively.

Meanwhile in money markets, the net surplus liquidity of Rs.8.202 billion saw overnight call money and repo rates remained steady to average 8.15% and 8.02% respectively yesterday.

Rupee dips marginally

The USD/LKR rate on the active spot next contract was seen dipping marginally to close the day at Rs. 146.25/30 against its previous day’s closing of Rs. 146.18/25 on the back of importer demand. The total USD/LKR traded volume for 9 May was $ 73.81 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 147.00/10; three months – 148.55/65; and six months – 150.95/15.