Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 1 August 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

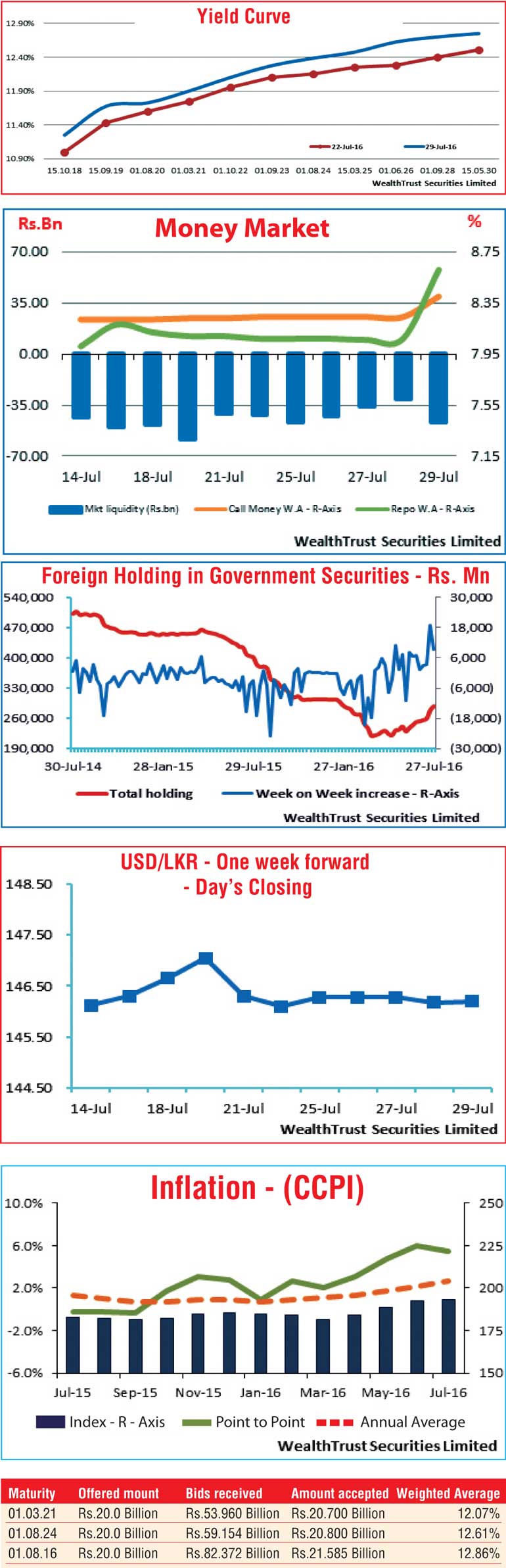

Secondary market bond yields increased across the boards during the week ending 29 July, driven by the outcome of the monetary policy announcement for the month of July where the Central Bank of Sri Lanka increased its policy rates by 50 basis points to 7% and 8% respectively on the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR).

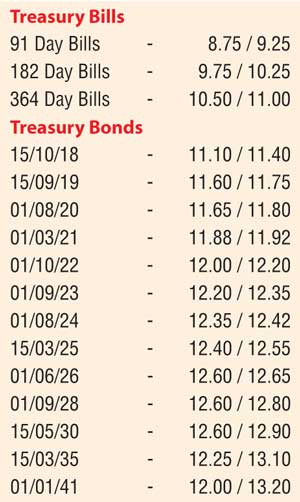

Yields of the liquid maturities 01.01.24 and 01.06.26 increased by 50 and 62 basis points respectively to intra week highs of 12.70% and 12.90% in comparison to last week’s yields. However, buying interest at these levels, subsequent to the Treasury bond auction, curtailed rates from moving up any further and the market closed at levels of 12.35/42 and 12.60/65 respectively.

Furthermore, two-way quotes of the 15.09.19, 01.03.21 and 15.03.25 maturities increased to levels of 11.60/75, 11.88/92 and 12.40/55 respectively against their previous weeks closing levels of 11.42/44, 11.72/77 and 12.22/28.

Foreign buying in to Rupee bonds continued for an eighth consecutive week, recording an inflow of Rs. 9.4 billion for the week ending 27 July.

At the weekly Treasury bill auction, the weighted averages declined for a third consecutive week, with the 182 day and 364 day bills recording decreases of 06 and 01 basis points respectively to 9.69% and 10.48%.

Similarly, the bond auction conducted on 29 July drew considerable interest recording weighted averages of 12.07%, 12.61% and 12.86% respectively for durations of 4 years and 7 months, 8 years and 10 year respectively.

In the meantime, according to the Department of Census, the Point to Point Inflation for the month of July decreased to 5.5% from 6.00% recorded in June, while the annual average inflation increased to 2.7% against its June figure of 2.2%.

In the money market, the base rate increase resulted in overnight call money and repo rates increasing during the latter part of the week to average 8.40% and 8.61% respectively, as against its previous week’s average of 8.23% and 8.09%.

The OMO (Open Market Operations) department of Central Bank infused liquidity throughout the week by way of overnight reverse repo auctions at weighted averages ranging from 7.98% to 8.36%.

Rupee deprecates marginally

The active one week forward contract was seen dipping marginally during the week to close the week at Rs. 146.15/25 against its previous day’s closing of Rs. 146.00/20 on the back of importer demand.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 61.19 million.

Given are some forward dollar rates that prevailed in the market: one month – 146.80/00; three months – 148.60/80; six months – 150.80/00.