Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 17 November 2015 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

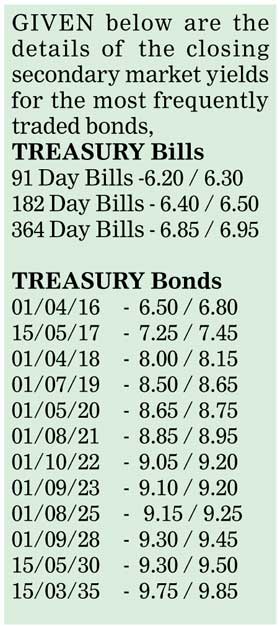

The yields in secondary market bonds remained mostly unchanged yesterday as activity dried up considerably. Limited amount of activity was seen on the long end of the curve, with the 1 September 2028 and the 15 March 2035 maturities changing hands within  the range of 9.30% to 9.35% and 9.75% to 9.85% respectively.

the range of 9.30% to 9.35% and 9.75% to 9.85% respectively.

In money markets, liquidity remained high at Rs.143.87 billion yesterday as overnight call money and repo rates remained steady to average 6.31% and 6.07% respectively.

Rupee dips further

The dollar/ rupee rate on spot contracts depreciated further yesterday to close the day at Rs. 142.20/30 in comparison to its previous day’s closing levels of Rs. 142.00/20 on the back of importer demand. The total USD/LKR traded volume for 13 November was $ 89.25 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 142.50/65; three months – 143.55/70 and six months – 144.65/75.

Rupee near record low on importer dollar demand

REUTERS: The Sri Lankan rupee ended weaker on Monday, not far from an all-time low hit in the previous session, on importer dollar demand, while a private bank’s greenback sales prevented further fall in the local currency, dealers said. |