Saturday Feb 07, 2026

Saturday Feb 07, 2026

Friday, 4 March 2016 00:46 - - {{hitsCtrl.values.hits}}

By Wealth

Trust Securities

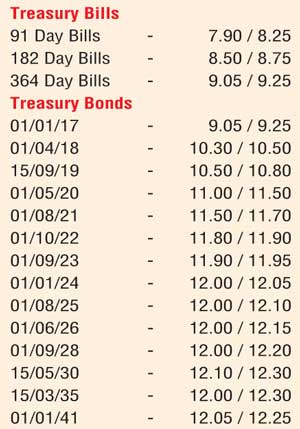

The secondary bond market yields remained broadly unchanged yesterday as activity moderated with a limited amount of movement witnessed once again on the 1 October 2022 and 1 September 2023 maturities within the range of 11.80% to 11.82% and 11.92% to 11.95% respectively. In secondary bill markets, the 91 day, 182 day and 364 day maturities were offered at levels of 7.90%, 8.50% and 9.05% respectively.

Meanwhile in money markets, overnight call money and repo rates averaged at 7.51% and 7.04% respectively as the surplus liquidity dipped further to Rs.32.84 billion yesterday.

Rupee depreciates marginally

The rupee on the active one week forward contracts was seen depreciating once again yesterday to close the day at Rs.144.85/95 against its previous day’s closing of Rs.144.75/85 on the back of renewed importer demand. The total USD/LKR traded volume for 1 March was $ 37.02 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 145.40/70; three months – 146.70/00; and six months – 148.80/20.