Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 9 August 2016 00:18 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

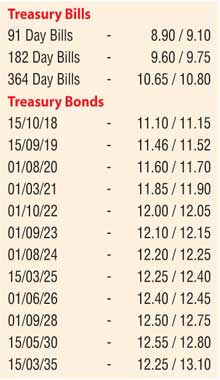

Secondary bond market yields remained broadly unchanged yesterday, as activity dried up considerably. Limited trades of the 01.03.2021 and 01.08.2026 maturities took place at levels of 11.85% and 12.45% to 12.48% respectively. In the secondary bill market the 182 day maturity was quoted at levels of 9.60/75.

Given below are the closing, secondary market yields of the most frequently traded maturities,

Meanwhile in money markets, Overnight call money and repo rates averaged 8.40% and 8.49% respectively as the net liquidity shortfall in the system stood at Rs.47.14 billion. The Open Market Operations (OMO) Department of the Central Bank injected an amount of Rs.46.00 billion on an overnight basis by way of a Reverse Repo auction at a weighted average of 8.30%.

shortfall in the system stood at Rs.47.14 billion. The Open Market Operations (OMO) Department of the Central Bank injected an amount of Rs.46.00 billion on an overnight basis by way of a Reverse Repo auction at a weighted average of 8.30%.

The rupee on active one week forward contracts was seen depreciating once again to close the day at Rs.145.90/98 against its previous day’s closing levels of Rs.145.75/85 while spot next contracts were at levels of Rs.145.75/80.

The total USD/LKR traded volume for the 04th of August 2016 was $ 47.30 million.

Given below are some forward USD/LKR rates that prevailed in the market: 1 Month- 146.60/80, 3 Months -148.25/40, and 6 Months-150.60/80

Reuters: The rupee ended slightly weaker in dull trade on Monday due to mild importer dollar demand, but the fall was capped as dealers were reluctant to trade below 145.60 levels fearing intervention by the central bank, dealers said.

The rupee gained last week as foreign investors sold dollars to buy local shares, expecting better profits from corporates on hopes that the latest rate hike would help improve the island nation’s macro-economic outlook.

The spot rupee ended at 145.60/75 per dollar, compared with Friday’s close of 145.55/65.

Dealers said there was mild importer dollar demand and that no bank wanted to trade below 145.60 levels on concerns over the central bank’s moral suasion, though the central bank was not seen in the market.

The spot rupee is usually managed by the central bank, and market participants use the forward market levels for guidance on the currency.

Since a $1.5 billion inflow from a duel-tenure sovereign bond issue, the central bank has largely not intervened in the currency market to defend the rupee. Central Bank officials were not available for comments.

One-week rupee forwards ended at 145.93/97 per dollar, compared with Friday’s close of 145.80/90.

The central bank on 28 July raised its main interest rates by 50 basis points each in a surprise move aimed at curbing stubbornly high credit growth that is adding to concerns about inflationary pressures.

Foreign investors have bought Rs. 63.7 billion ($438.86 million) worth of government securities, since the IMF agreed to a $1.5-billion bailout package, from 29 April through 3 Aug., central bank data showed.

Reuters: Shares ended slightly weaker in dull trade on Monday, slipping from their more than seven-week closing high hit in the previous session, as investors waited for firm direction on the government’s economic policies.

The benchmark Colombo stock index ended 0.16%, or 10.20 points weaker, at 6,506.93 on Monday.

On Friday, the index hit a more than seven-week high as investors bought blue chips expecting better profits on hopes that the Central Bank’s rate hike would help improve the island nation’s macro-economic outlook.

“There has been little bit more interest in the market. But institutional and foreign buying was less compared to retail investor buying as many investors are waiting for the government’s economic policies,” said Acuity Stockbrokers COO Prashan Fernando.

“With the better June-quarter profits, investors are interested in the stocks than earlier. But they also need some concrete policy decision on the economy.”

Stockbrokers said the market was waiting for a policy announcement on the economy from Prime Minister Ranil Wickremesinghe, scheduled later this month.

Shares have risen on hopes economic fundamentals would improve after the Central Bank on 28 July raised its main interest rates by 50 basis points each in a surprise move aimed at curbing stubbornly high credit growth that is adding to concerns about inflationary pressures.

Turnover stood at Rs. 372.9 million ($2.57 million), it’s lowest since 27 July and around half of this year’s daily average of around Rs. 731.6 million.

Overseas investors were net buyers of Rs. 41.4 million worth of shares on Monday, extending the net foreign inflow during the last nine sessions to Rs. 992.7 million worth of equities.

However, they have been net sellers of Rs. 3.81 billion worth of shares so far this year.

Shares in Nestle Lanka Plc fell 1.8%, while Lanka ORIX Leasing Company Plc ended 1% weaker.

Sri Lanka Telecom Plc closed 1.6% weaker, dragging the overall index down.

Top mobile operator Dialog Axiata Plc, which posted an 18.6% gain in June-quarter profit earlier in the day, closed up 0.9%.