Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 10 August 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

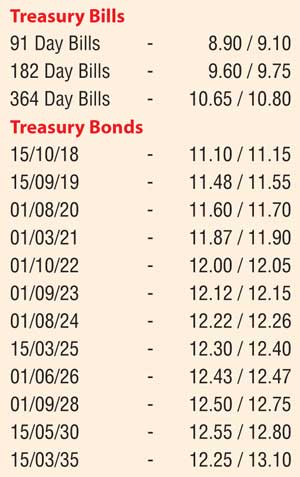

Secondary market bond yields continue to remain steady with the liquid maturities of 01.09.23 and 01.06.26 trading at levels of 12.15% and 12.45% to 12.50% respectively, against the pre rate hike closings levels of 12.18/28 and 12.50/55.

Furthermore, maturities of15.09.19, 01.03.21, 01.08.24 and 01.08.26 were seen changing hands at levels of 11.53%, 11.87% to 11.89%, 12.22% to 12.26% and 12.45% to 12.50% respectively.

This week’s Treasury bill primary auction to be held today, will have on offer a total amount of Rs.25.5 billion, consisting of Rs.5.5 billion of the 91 day maturity and Rs.10 billion each of the 182 day and the 364 day maturities. Following the monitory policy rate hike, the weighted averages at last week’s auction increased by 19, 21 and 25 basis points respectively to 8.99%, 9.90% and 10.73%.

Meanwhile in money markets, Overnight call money and repo rates averaged 8.40% and 8.49% respectively as the Open Market Operations (OMO) Department of the Central Bank injected an amount of Rs. 44.00 billion on an overnight basis by way of a Reverse Repo auction at a weighted average of 8.31%.

Rupee appreciates marginally

The rupee on active one week forward contracts was seen appreciating once again to close the day at Rs.145.80/85 against its previous day’s closing levels of Rs.145.90/98 while spot next contracts were at levels of Rs.145.65/69.

The total USD/LKR traded volume for 5 August was $ 38.95 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 146.60/80; three months – 148.20/40; six months – 150.50/70.

Reuters: Shares closed almost steady on Tuesday, with investor sentiment boosted by foreign investor buying, while markets waited for some firm direction on the Government’s economic policies.

The benchmark Colombo stock index ended 0.05%, or 3.18 points, firmer at 6,510.11, hovering near a more than seven-week high hit on Friday.

Foreign investors, who have sold a net Rs. 3.56 billion ($24.51 million) in shares so far this year, bought shares worth a net 252 million rupees on Tuesday, extending the net foreign inflow in the last 10 sessions to Rs. 1.24 billion of equities. “Investors are cautiously buying. We see retail investors are buying while some profit-taking is happening too,” said Reshan Kurukulasuriya, Chief Operating Officer of Richard Pieris Securities Ltd.

“Investors are optimistic and they are buying on earning hopes.”

Stockbrokers said the market was waiting for a policy announcement on the economy from Prime Minister Ranil Wickremesinghe, scheduled later this month.

Analysts shrugged off a Supreme Court decision to stop considering a bill to raise the country’s Value-Added Tax because the draft has not followed due process as the Government has said it will raise the tax with due process.

Shares have risen on hopes economic fundamentals would improve after the Central Bank on 28 July raised its main interest rates by 50 basis points each in a surprise move aimed at curbing stubbornly high credit growth that is adding to concerns about inflationary pressures.

Turnover stood at Rs. 940.2 million ($6.47 million) on Tuesday, more than this year’s daily average of around Rs. 731.6 million.

Conglomerate John Keells Holdings edged up 1.56%, while Ceylon Cold Stores jumped 6.2%.

Reuters: The rupee ended steady on Tuesday as dollar demand by importers was offset by conversions of the US currency from exporters amid concerns that price controls by the Government could hurt imports, dealers said.

Two Sri Lankan economists last week told a summit attended by President Maithripala Sirisena and his Finance Minister that the Government’s economic policies were destabilising and inconsistent, with one calling its price controls “supreme idiocy”.

The Central Bank on 28 July raised its main interest rates by 50 basis points each in a surprise move aimed at curbing stubbornly high credit growth that is adding to concerns about inflationary pressures.

The rupee gained last week as foreign investors sold dollars to buy local shares, expecting better profits from corporates on hopes that a recent rate increase by the country’s Central Bank would help improve the island nation’s macro-economic outlook.

The spot rupee ended at 145.60/65 per dollar, hardly changed from Monday’s close of 145.60/75.

The spot rupee is usually managed by the Central Bank, and market participants use the forward market levels for guidance on the currency.

“There was exporter dollar selling by a local bank which offset importer dollar demand,” a currency dealer said, asking not to be named.

“The Government’s price controls are hurting the imports and the central bank is trying its best to curb credit demand after the recent rate hike.”

Since a $1.5 billion inflow from a dual-tenure sovereign bond issue, the Central Bank has largely not intervened in the currency market to defend the rupee. Central Bank officials were not available for comment.

One-week rupee forwards ended at 145.80/90 per dollar, compared with Monday’s close of 145.93/97.

Foreign investors have net bought Rs. 63.7 billion ($437.50 million) worth of Government securities from 29 April through 3 August, Central Bank data showed.