Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 4 August 2015 00:53 - - {{hitsCtrl.values.hits}}

Rupee and liquidity increase to over two-month high

By Wealth Trust Securities

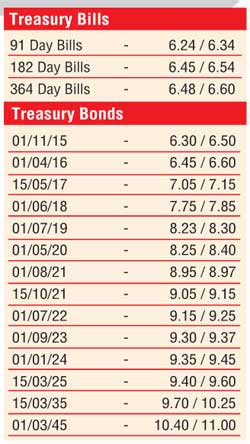

The yields in secondary market bonds were seen edging up marginally yesterday on thin trades ahead of today’s Treasury bond auctions.

Selling interest on the planned auction maturities of 01.07.2019 and 01.08.2021, along with the 01.09.2023, saw its yields edge up to  intraday highs of 8.25%, 8.96% and 9.33% respectively against its days opening lows of 8.22%, 8.93% and 9.30%.

intraday highs of 8.25%, 8.96% and 9.33% respectively against its days opening lows of 8.22%, 8.93% and 9.30%.

Today’s bond auctions will have on offer Rs. 5 billion each on a 3.11-year maturity of 1 July 2019 and a 6.00 year maturity of 1 August 2021 and a further Rs. 10 billion on the 10-year maturity of 01.08.2025. The previous auction of these exact maturities fetched weighted averages of 8.19% and 8.87% while all bids for the 10-year maturity were rejected.

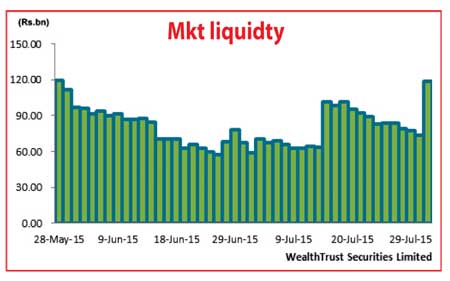

Meanwhile, in money markets yesterday, liquidity was seen increasing to over a two-month high of Rs. 118.80 billion following an Rs. 88.6 billion bond maturity. However, overnight call money and repo rates remained steady to average 6.13% and 5.87% respectively.

Rupee appreciates once again

The USD/LKR rate on spot contracts appreciated further by 10 cents yesterday to a two-and-a-half-month high of Rs. 133.50. The total USD/LKR traded volume for the previous day (30-07-15) was $ 21.75 million.

Some of the forward dollar rates that prevailed in the market were 1 month - 134.10/30; 3 months - 135.00/20 and 6 months - 136.35/55.