Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 14 March 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The upward trend in secondary market bond yields continued for an eighth consecutive week as liquidity in the system turned negative for the first time since March 2014. This, coupled with the downgrade to Sri Lanka’s rating outlook to Negative from Stable by Standard and Poor’s Rating Services, saw market sentiment turning negative during the week ending 11 March.

This sentiment was seen affecting the primary market auctions, as all bids for the weekly Treasury bill auction and the subsequent Treasury bond auction were rejected due to higher yields demanded by market participants according to sources.

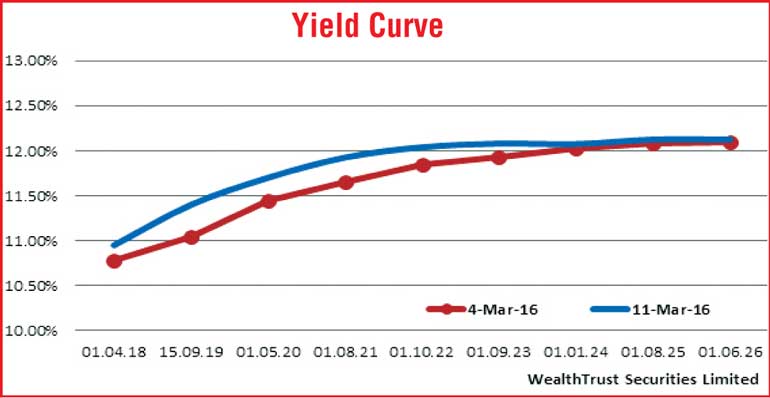

In secondary bond markets, activity was seen decreasing considerably during the week with the liquid maturities of 1 August 2021, 1 July 2022 and 1 September 2023 hitting weekly highs of 12.00%, 12.09% and 12.08% respectively against its previous weeks closing levels of 11.55/75, 11.80/90 and 11.90/95.

Furthermore selling interest in early 2017 and 2018 maturities saw it change hands within the range of 9.20% to 9.35% and 10.90% to 11.00% respectively. This led to an upward shift of the yield curve on the short end the belly end of the curve. Meanwhile, the foreign holding in Rupee bonds was seen reducing by Rs. 20.64 billion for the week ending 9 March, recording its ninth consecutive week of out flows.

In money markets, the average market liquidity reflected a drop of Rs. 29.98 billion week on week as it registered a net deficit of Rs. 6.6 billion on Thursday 10 March. This in turn saw weekly averages on overnight call money and repo rates increasing to 7.72% and 7.71% respectively against its previous week’s averages of 7.52% and 7.02% while recording two year highs of 7.85% and 8.50% respectively as well during the week ending 11 March.

The Standard Lending Facility Rate of 8.00% was accessed all throughout the week, even as liquidity reversed back to a net surplus of Rs. 21.46 billion on Friday due to the maturing Treasury bill proceeds entering the system.

Rupee loses ground during the week

The rupee on active one week forward contracts depreciated further during the week to close the week at Rs. 145.15/25 against its previous weeks closing of Rs. 145.05/25 on the back of importer demand. The daily USD/LKR average traded volume during the first three days of the week stood at $ 60.29 million.

Given are some forward dollar rates that prevailed in the market: one month – 145.90/00; three months – 147.35/45; six months – 149.60/70.