Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 27 January 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

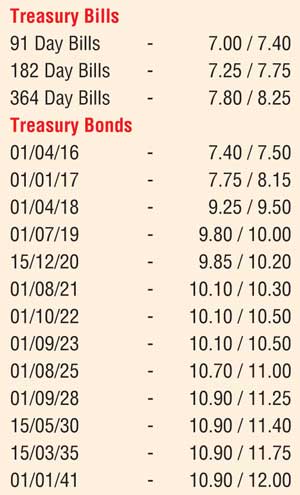

The yields on the very short end of the yield curve were seen spiking once again yesterday ahead of today’s weekly Treasury bill auction. Selling interest on the 1 August 2016 (185 days) and the 1 September 2016 (216 days) maturities saw its yields increase to daily highs of 7.80% and 7.85% respectively. At today’s auction a total amount of Rs.22.5 billion will be on offer consisting of Rs.2.5 billion on the 91 day maturity and Rs.10 billion each on the 182 day and 364 day maturities. At last week’s auction, the weighted averages on the 182 day and 364 day bills increased by 13 and 32 basis points respectively to 7.19% and 7.80%, while the 91 day bill was not on offer.

In addition, selling interest on the belly end of the curve saw yields on the 01.09.2023 maturity hit a daily high of 10.65% as well against its opening low of 10.50% as activity on the rest of the curve remained dull.

Meanwhile in money markets, the overnight call money and repo rates averaged at 6.80% and 6.54% respectively as overall surplus liquidity stood at Rs.56.13 billion yesterday.

Rupee remains stable

In Forex markets, the USD/LKR rate on spot contracts closed the day mostly unchanged at Rs.144.00/20 yesterday as markets were at equilibrium. The total USD/LKR traded volume for the 25th of January 2016 was US $ 44.80 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.65/85; 3 Months - 145.85/10 and 6 Months - 147.65/85.