Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 5 August 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weighted average at yesterday’s six-year bond auction of 1 August 2021 was seen increasing by 20 basis points to 9.07% against its previously recorded average, while the ten-year maturity of 1 August 2025 was seen recording an impressive weighted average of 9.63%.

All bids for the 3.11-year maturity of 1 July 2019 were rejected while a total amount of Rs. 25.7 billion was accepted on the six- and ten-year maturities against a total offered amount of Rs. 20 billion on all three maturities.

In secondary market bonds yesterday, yields on the six-year maturity were seen increasing to an intraday high of 9.08% following the outcome of the auction. However, buying interest at these levels saw yields dip once again to an intraday low of 8.99%.

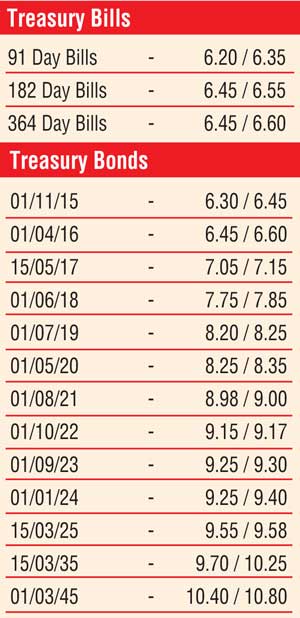

In addition, a limited amount of activity was witnessed on the 01.07.2019 and the 01.09.2023 maturities within the range of 8.23% to 8.25% and 9.28% to 9.30% respectively. Meanwhile, today’s weekly Treasury bill auction will see an total amount of Rs. 16 billion on offer consisting of Rs. 8 billion each on the 182-day and 364-day maturities while the 91-day will not be auction for the first time in 33 weeks. At last week’s auction, weighted averages increased across the board to record 6.28%, 6.43% and 6.48% respectively on the 91-day, 182-day and 364-day maturities.

In money markets, surplus liquidity continued to remain high at Rs. 116.16 billion yesterday as call money and repo rates were seen averaging 6.10% and 5.85% respectively.

Rupee remains steady

The USD/LKR rate on spot contracts remained steady to close the day at Rs. 133.50. The total USD/LKR traded volume for the previous day (03-08-15) was $ 26.17 million.

Some of the forward dollar rates that prevailed in the market were one month - 134.10/15; three months - 135.00/20 and six months - 136.45/65.

Reuters: The rupee ended steady on Tuesday as dollar selling by a State-run bank offset importer demand for the greenback, dealers said, a day after the State bank cut the currency’s peg by 10 cents to allow the exchange rate to appreciate to 133.50, dealers said.

The rupee ended at 133.50 per dollar on Tuesday.

“There was importer dollar demand throughout. Exporters are not selling dollars because of the upcoming elections,” a currency dealer said on condition of anonymity. Some dealers expect the currency to be less volatile until the 17 August Parliamentary elections.