Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 18 July 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The start of the week ending 15 July 2016 saw the Central Bank of Sri Lanka launch and successfully complete its first dual tranche sovereign dollar bond issue for 2016 at very attractive yields.

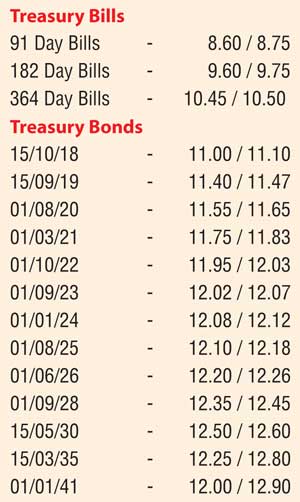

This, coupled with the robust outcomes at the Treasury bill and bond auctions, saw the secondary bond market continue its bullish sentiment for a third consecutive week as yields decreased across the curve.

Activity primarily centred on the belly end of the curve, comprising the maturities of 01.10.22, 01.09.23, 01.01.24, the two 2025’s (15.03.25 & 01.08.25) and 01.06.26 as its yields were seen dipping to weekly lows of 11.82%, 11.92%, 11.95%, 12.07% and 12.10% each respectively against its weeks opening highs of 11.98%, 12.05%, 12.10%, 12.20% each and 12.30%.

In addition, on the short end of the curve, 2018 maturities along with 2019 maturities were seen changing hands within the range of 11.00% to 11.10% and 11.30% to 11.50% as well. However, the downward movement in yields was seen curtailed towards the latter part of the week on the back of profit-taking.

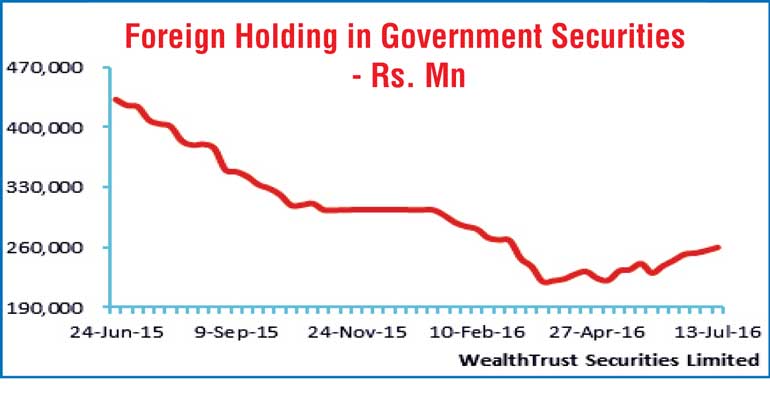

Furthermore, the foreign holding in Rupee bonds continued its upward trajectory for a sixth consecutive week as its holding edged up by Rs. 3.55 billion for the week ending 13 July 2016.

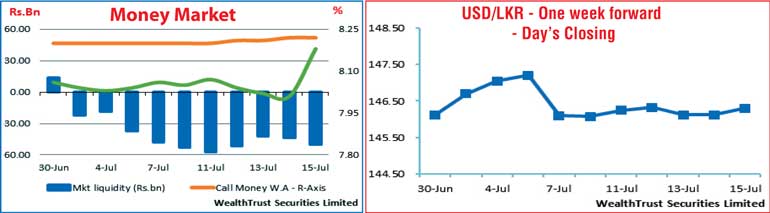

In the money market, overnight call money and repo rates remained steady during the week despite system liquidity remaining negative due to the OMO (Open Market Operations) department of Central Bank infusing liquidity throughout the week by way of overnight reverse repo auctions. Call money and repo averaged 8.21% and 8.06% respectively for the week as net liquidity averaged a shortfall of Rs. 48.852 billion for the week as well.

Rupee dips marginally

The USD/LKR rate dipped marginally to close the week at Rs. 146.25/35 on its one-week forward contract against its previous week’s closing of Rs. 145.95/20. The daily USD/LKR average traded volume for the first four days of the week stood at $ 60.21 million.

Some of the forward dollar rates that prevailed in the market were one month - 146.85/10; three months - 148.40/60 and six months - 150.85/05.