Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 3 February 2017 00:00 - - {{hitsCtrl.values.hits}}

Reuters: Shares closed slightly higher on Thursday, snapping two straight sessions of falls, as investors picked up battered blue chips while net foreign buying also boosted sentiment.

Reuters: Shares closed slightly higher on Thursday, snapping two straight sessions of falls, as investors picked up battered blue chips while net foreign buying also boosted sentiment.

Investors await clarity on interest rates from the Central Bank’s first monetary policy in 2017 scheduled on Tuesday.

The Colombo stock index ended up 0.15% at 6,139.56, while turnover was Rs. 1.09 billion ($ 7.26 million), higher than this year’s daily average of Rs. 645 million.

“People are looking at cheap stocks and collecting,” said Reshan Kurukulasuriya, chief operating officer, Richard Pieris Securities Ltd. “Investors collect stocks at these levels when they see a stock is attractive.”

Foreign investors, who have been net sellers of Rs. 1.62 billion worth of shares so far this year, net bought Rs. 27.1 million worth of equities on Thursday.

Shares of Nestle Lanka Plc rose 2.48%, Commercial Bank of Ceylon Plc, the country’s biggest listed lender, climbed 1.82%, and conglomerate John Keells Holdings Plc gained 0.43%.

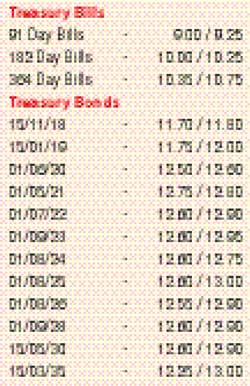

Sri Lankan shares have been on a declining trend recently due to political uncertainty arising from a decision by the ruling coalition parties to contest local polls separately and on worries over a rise in market interest rates with yields on 91-day treasury bills hitting near four-year highs this week.

By Wealth Trust Securities

In the secondary bond market, activity moderated yesterday with the 15.11.18, the two 2019 maturities (i.e. 01.07.19 and 01.11.19), the 01.05.21 and the 01.01.24 maturities changing hands within the range of 11.75% to 11.77%, 11.97% to 12.25%, 12.75% to 12.80% and 12.62% to 12.67% respectively.

In money markets, the Open Market Operations (OMO) Department of the Central Bank was seen mopping up an amount of Rs. 42.00 billion on an overnight basis at a weighted average of 7.52% as the net surplus liquidity stood at Rs. 37.70 billion yesterday. The overnight call money and repo rates averaged at 8.40% and 8.47% respectively.

The USD/LKR rate on the active two weeks as well as the one-month forward contracts deprecated marginally yesterday to close the day at Rs. 151.07/10 and Rs. 151.44/50 respectively against its previous day’s closing levels of Rs. 150.90/05 and Rs. 151.25/40.

The total USD/LKR traded volume for 1 February 2017 was $ 116.75 million.

Some of forward USD/LKR rates that prevailed in the market were three months - 153.30/45 and six months - 155.80/95.

Reuters: The rupee ended marginally weaker on Thursday due to dollar demand from importers as well as banks to facilitate foreign outflows from government securities, dealers said.

Rupee forwards were active, with two-week forwards closing at 151.02/10, slightly weaker from Wednesday’s close of 151.00/10.

“The rupee continues to be under pressure. It is reflected in the Central Bank’s continuous moves to lower the reference rate,” a currency dealer said, requesting anonymity.

The Central Bank had revised the spot rupee reference rate to a record-low of 150.50 from 150.25 on Tuesday.

“This means they do not want a stronger currency and want to allow gradual depreciation.”

The rupee also faces depreciation pressure due to seasonal importer dollar demand, dealers said.

Finance Minister Ravi Karunanayake said it was a turbulent time and the Government would navigate it “in a correct manner”.

“I wouldn’t want to speculate at all. But you’ll be surprised of what we will be doing,” Karunanayake told reporters in Colombo when asked about the Government’s outlook on the rupee.

The rupee has been under pressure due to rising imports and net selling of government securities by foreign investors, while the Central Bank has said defending the currency was not sensible.

Foreign investors net sold Rs. 21.1 billion ($ 140.6 million) worth of government securities in the three weeks to 25 January, according to latest Central Bank data.