Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 25 May 2016 00:00 - - {{hitsCtrl.values.hits}}

Reuters: Shares fell for the third straight session on Tuesday to a three-week closing low, led down by large caps and stocks likely to be hit by the country’s worst natural disaster since the 2004 Asia tsunami.

The benchmark stock index fell 0.95%, or 62.69 points, to 6,570.58, its lowest close since 4 May.

The index fell 1.12% last week, its first weekly fall in seven weeks. On Monday, the Government said the cost of landslides and floods will be between $1.5 billion and $2 billion at the minimum, as it struggles to recover from days of torrential rains that have so far claimed the lives of 94 people.

“Flood situation was the main reason for the drag down. People have started to realise the real impact and going forward more negativity should come into the market,” said Yohan Samarakkody, Head of Research, SC Securities Ltd.

Lion Brewery Plc dropped 4.76% on Tuesday, after the alcoholic beverages manufacturer said last week it had halted production in its main factory in a Colombo suburb due to the floods. It fell 3.45% on Monday.

Stockbrokers said manufacturing and banking sectors are likely to be hit due to the low employee turnout during the floods.

Concerns over a government move to increase the value added tax and impose new taxes effective 2 May, which could hit the bottom line of many companies, also dented sentiment. Turnover was Rs. 762.9 million ($5.23 million), in line with this year’s daily average of around Rs. 796.1 million.

Foreign investors, who have net sold Rs. 4.26 billion worth equities so far this year, were net buyers of Rs. 44.8 million worth of shares on Tuesday.

Sri Lanka Telecom Plc fell 4.42% and conglomerate John Keells Holdings Plc lost 0.19%, dragging down the overall index.

By Wealth Trust Securities

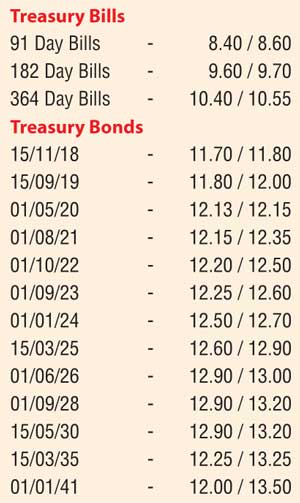

The wait-and-see policy adopted by most market participants coupled with selling interest ahead of primary auctions, saw bond yields increase yesterday in thin trade. The liquid maturities of 01.05.2020 and 01.06.2026 were seen increasing to highs of 12.15% and 12.95% respectively against its days opening lows of 12.12% and 12.90%.

This was ahead of today’s weekly Treasury bill auction, at where a total amount of Rs.30 billion is on offer consisting of Rs. 11 billion each on the 91 day and 182 day maturities and a further Rs.8.0 billion on the 364 day maturity.

At last week’s auction, the weighted averages on the 91 day and 364 day bills increased by 14 and 11 basis points respectively to 8.66% and 10.48% while all bids received for the 182 day bill were rejected. Furthermore Treasury bond auctions amounting to Rs.45 billion is scheduled for tomorrow (26) as well.

Meanwhile in money markets, overnight call money and repo rates remained steady to average 8.15% and 8.00% respectively as the net surplus liquidity in the system stood at Rs.6.33 billion.

Rupee dips marginally

The USD/LKR rate on the active spot next contract depreciated marginally to close the day at Rs. 146.95/00 against its Friday closing level of Rs.146.80/95 on the back of importer demand. The total USD/LKR traded volume for 20 May was $ 17.83 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 147.80/75; three months – 149.40/70; and six months – 151.80/05.

Reuters: Rupee forwards ended weaker on Tuesday as dollar demand from importers offset selling by banks, amid the currency expected to weaken on a possible increase in Government spending after the worst natural disaster since 2004. On Monday, the Government said the cost of landslides and floods, following days of torrential rains, will be between $1.5 billion and $2 billion at the minimum, as the Indian Ocean island struggles to recover from its worst natural disaster since the 2004 Asia tsunami.

The dollar/rupee forwards, known as spot next, ended at 146.98/147.10 per dollar compared with Friday’s close of 146.85/90. Markets were closed on Monday for a special bank holiday.

“There was no (dollar) liquidity in the market as there were not much of dollar sales by exporters or banks but the demand (for dollars) was there from importers,” a currency dealer said, asking not to be named.

“If the expected foreign inflows do not come, it could weigh on the rupee with high borrowing.”

Finance Minister Ravi Karunanayake told Parliament last week that Japan would lend Sri Lanka more than $3.5 billion, mostly to finance development.

The currency would stabilise in the 146.00 per dollar range in early June after money from an IMF loan flows in, Karunanayake also said.

The spot currency did not trade on Tuesday. The spot rupee reference rate has been pegged at 145.75, dealers said. Sri Lanka’s Central Bank had fixed the spot rate at 143.90 per dollar until 2 May.