Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 17 February 2016 00:00 - - {{hitsCtrl.values.hits}}

Reuters: Shares ended lower for the seventh straight session on Tuesday as rising domestic interest rates and global economic worries dampened investor sentiment.

The main stock index ended down 0.19% at 6,254.16, its lowest close since 7 May 2014, after erasing early gains. It has fallen 2.35% in the last seven sessions.

“Market is down because there is not much of an economic direction and also due to the global market volatility,” said Reshan Kurukulasuriya, Chief Operating Officer of Richard Pieris Securities Ltd.

“But if global markets settle with oil prices settling, it might be good news for emerging markets also.”

Brent crude, which has been on a roller-coaster ride this year, hit a 12-day high after oil producers Russia, Saudi Arabia, Qatar and Venezuela agreed to freeze output to tackle a global oil glut.

The key index has fallen 9.3% this year through Monday, amid a rise in market interest rates.

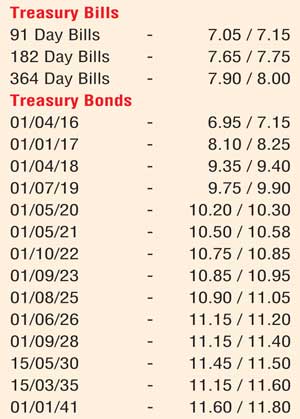

Yields on T-bills rose between eight and 17 basis points at a weekly auction on Wednesday, with the 182-day and the 364-day T-bill yields climbing to more-than-two-year highs, signalling a further rise in market interest rates.

Turnover was Rs. 358.6 million, less than half of this year’s daily average of Rs. 721 million.

Foreign investors were net buyers of Rs. 52.05 million worth of shares on Tuesday. But they have been net sellers of Rs. 293.7 million worth of shares so far this year.

Shares of Dialog Axiata Plc fell 1% while Aitken Spence Hotel Holdings Plc eased 2.7% and Hayleys Plc lost 2.3%.

By Wealth Trust Securities

Activity as well as yields in the secondary bond market were seen picking up, with considerable selling interest, ahead of today’s primary Treasury bill auction.

The liquid maturities of 1 May 2021, 1 June 2026 and 15 May 2030 were seen hitting intraday highs of 10.55%, 11.20% and 11.46% respectively against its previous day’s closing levels of 10.46/50, 11.00/10 and 11.28/35. Furthermore, movement was also witnessed consisting of the two 2018 maturities (i.e. 1 April 2018 and 15 July 2018) and the 1 September 2023 maturity at yields ranging between 9.37% to 9.43% and 10.85% to 10.90% respectively.

In the meantime, the shorter bond maturity of 1 January 2017 was seen quoted at highs of 8.05/25 while Bills maturing in May and August 2016 were quoted at levels of 7.05/15 and 7.65/75 respectively.

Today’s bill auction will have on offer a total amount of Rs.23 billion consisting of Rs.5 b on the 91 day, Rs.10 billion on the 182 day and Rs.8 b on the 364 day maturities. At last week’s auction, the weighted average yields of the 182 and 364 day maturities increased to 7.57% and 7.95% respectively while the 91 day maturity was not offered.

Meanwhile in money markets, overnight call money and repo rates increased further to average 6.95% and 6.62% respectively, despite the Open Market Operations (OMO) department of the Central Bank infusing an amount of Rs.3.00 billion, at a weighted average yield of 6.59% by way of an overnight reverse repo auction, resulting in a net surplus liquidity of Rs. 19.13 b.

Rupee on active one week forward contracts depreciates further

The USD/LKR rate on active one week forward contracts was seen depreciating further to close the day at Rs.144.50/58 against its previous day’s closing levels of Rs.144.45/55.

The total USD/LKR traded volume for 13 February was $ 35.25 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 144.70/95; three months – 146.10/30; and six months – 148.10/40.

Reuters: Sri Lankan rupee forwards ended steady on Tuesday, recouping early losses as dollar sales by a foreign bank offset importer dollar demand, dealers said.

Dealers expect the currency to depreciate further due to rising imports, selling of government securities by foreign investors and slowing dollar inflows.

One-week rupee forwards, which act as a proxy for spot, ended steady at 144.50/55 per dollar.

Rupee forwards have been active since 27 January as there has been little trading in the spot currency, with banks reluctant to trade below the 144.00 level amid moral suasion by the Central Bank.

Central Bank officials did not respond to calls seeking comment.

“The demand was there from importers. But we have seen a foreign bank selling dollars. It may be due to inflow to the bank,” said a currency dealer asking not to be named.

Currency dealers also said foreign investors exiting government securities were putting pressure on the currency.

Foreign investors sold Rs. 3.07 billion ($21.33 million) worth of government securities between 3 – 10 February, data from the Central Bank showed, taking the total offloading since 30 December 2015 to Rs. 22.4 billion.

The rupee is under pressure due to a lack of inflows, and a pick-up in importer demand ahead of the festive season in April, dealers said.

Sri Lanka needs to pay more than $5 billion in foreign loans including interest payments in 2016, while its reserves were only around $6.3 billion at the end of January, according to Central Bank data.

Dealers said the Central Bank would not be able to hold the rupee at current levels without strong dollar inflows.

The Central Bank usually intervenes in times of high volatility though it floated the rupee on 4 September 2015.

Commercial banks parked Rs. 22.132 billion ($153.59 million) of surplus liquidity on Tuesday, using the Central Bank’s deposit facility at 6%, official data showed.

The Central Bank conducted an overnight reverse repo auction to inject rupee liquidity into the market, dealers said. The Central Bank accepted Rs. 3 billion worth of bids at weighted average yield of 6.59 % after receiving Rs. 5 billion worth of bids. The Central Bank offered Rs. 20 billion at the auction.