Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 23 December 2015 00:00 - - {{hitsCtrl.values.hits}}

Reuters: Sri Lankan shares fell to a near one-week closing low on Tuesday, led by market heavyweight John Keells Holdings, in thin trade as investors kept to the sidelines ahead of holidays later in the week.

Turnover slumped to the lowest level since March 24, 2014 at 262.9 million rupees ($1.83 million), against this year’s daily average of 1.08 billion rupees.

“There is no reason for the fall. It is a year-end market and there are hardly any investors,” said Danushka Samarasinghe, research head at Softlogic Stockbrokers.

“Market sentiment next year will depend on how the government is going to fund its fiscal deficit and on foreign inflows into the country.”

The market is expected to be lacklustre with low turnover due to year-end holidays starting this week, stockbrokers said.

Markets will be closed on Thursday for a Buddhist religious holiday and Friday for Christmas.

The main stock index ended 0.39 percent weaker at 6,854.57, its lowest close since Dec. 16.

Foreign investors sold a net 19.2 million rupees worth of equities, extending the net outflow to 4.26 billion rupees so far this year.

John Keells Holdings, the country’s top conglomerate, accounted for around 56 percent of the day’s turnover. It closed 2.8 percent lower, while large cap Ceylon Tobacco fell 0.5 percent.

Reuters: The Sri Lankan rupee ended steady on Tuesday amid thin trade as many investors stayed away in a holiday-shortened week, currency dealers said.

The markets will be closed on Thursday for a Buddhist religious holiday and Friday for Christmas.

The rupee closed at 143.65/85 per dollar, nearly unchanged from Monday’s close of 143.65/90. It hit a record low of 143.80 last week.

“There were only a few trades,” a currency dealer said asking not to be named. The currency edged up earlier in the day due to a few exporter conversions, dealers said.

The rupee has fallen 6.2 per cent since the Central Bank allowed free float of the currency on Sept. 4. It has fallen 8.7 per cent so far in the year.

The rupee will remain weak next year unless Sri Lanka tightens monetary and fiscal policy, dealers say, as the country has low interest rates, little foreign currency reserves and is highly dependent on imports.

Finance Minister Ravi Karunanayake told parliament last week that Sri Lanka’s foreign exchange reserves were at “a healthy” $6.1 billion. That figure is however 26 per cent lower than the country’s reserves at the end of 2014.

Sri Lanka is planning to extend a $1.5 billion currency swap with the Reserve Bank of India by one year, in a bid to boost its reserves.

Commercial banks parked 47.7 billion rupees ($332.06 million) of surplus liquidity on Tuesday using the Central Bank’s deposit facility at 6 per cent, while they borrowed 102 million rupees using the Central Bank’s lending facility at 7.5 per cent, official data showed.

By Wealth Trust Securities

Activity in secondary bond markets remained dull, ahead of today’s Treasury bond auction, the third such auction to be held within a span of 08 days. Furthermore, most market participants continued to be on the sidelines ahead of the monitory policy announcement for the month of December which is due within the next few days.

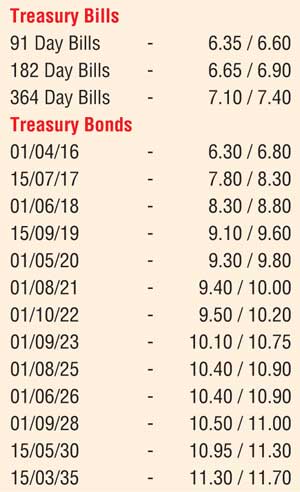

The bond auction had on offer a total amount of Rs.10 billion, consisting Rs.2.00 billion, Rs.3.00 billion and Rs.5.00 billion each of 5 year (12.12.2020) 7.08 year (01.09.2023) and 9.07 year (01.08.2035) maturities.

The previously recorded weighted averages of the said maturities were 9.56%, 10.25% and 10.36% respectively.

In the money market, the OMO (Open Market Operations) department of the Central Bank was seen mopping up an amount of Rs.16.00 Billion on an overnight basis at a weighted average of 6.14%, as surplus liquidity stood at Rs.63.59 Billion.

The overnight call money and repo rates remained steady to average 6.40% and 6.22% respectively.

Rupee trades within a narrow range

The USD/LKR on spot contracts continued to trade within a narrow span of Rs.143.63 – Rs.143.65.

The total USD/LKR traded volume for the 21st of December 2015 was US $ 45.75 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.30/40; 3 Months - 145.40/60 and 6 Months - 146.50/50.