Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 5 January 2017 00:50 - - {{hitsCtrl.values.hits}}

Reuters: Sri Lankan shares fell for a fourth straight session on Wednesday, to end at a near nine-month low, as investors sold large-cap shares on fears that continued foreign selling in John Keells Holdings could dampen market sentiment further.

Foreign investors sold a net Rs. 745 million worth of equities on Wednesday, the highest in a day since 22 September 2016, extending the net outflow in the first three trading sessions of the year to Rs. 815 million.

Worries over a weakening rupee and rising interest rates also weighed on the sentiment.

“Investors still don’t have the confidence to buy the shares,” said Atchuthan Srirangan, a senior research analyst with First Capital Equities Ltd.

“Amid interest rate volatility and policy uncertainties, they are not willing to buy for long term. They will wait to see the long-term picture.”

The Colombo stock index ended 0.1% down at 6,153.13, its lowest close since 4 April. The bourse fell 9.7% in 2016, its second straight annual decline.

The index dipped into the oversold territory further on Wednesday with the 14-day relative strength index extending its fall to 28.569 points versus Tuesday’s 29.238, Thomson Reuters data showed. A level between 30 and 70 indicates the market is neutral.

Conglomerate John Keells Holdings Plc, which saw net foreign selling of 5.22 million shares that accounted for 82% of the day’s turnover, however ended 1.2% higher on the back of bargain hunting by domestic investors.

Talks of a high net worth foreign investor exiting from Keells has triggered panic selling, dealers said.

Yields on treasury bill auctions rose 5-6 basis points at a weekly auction on Wednesday.

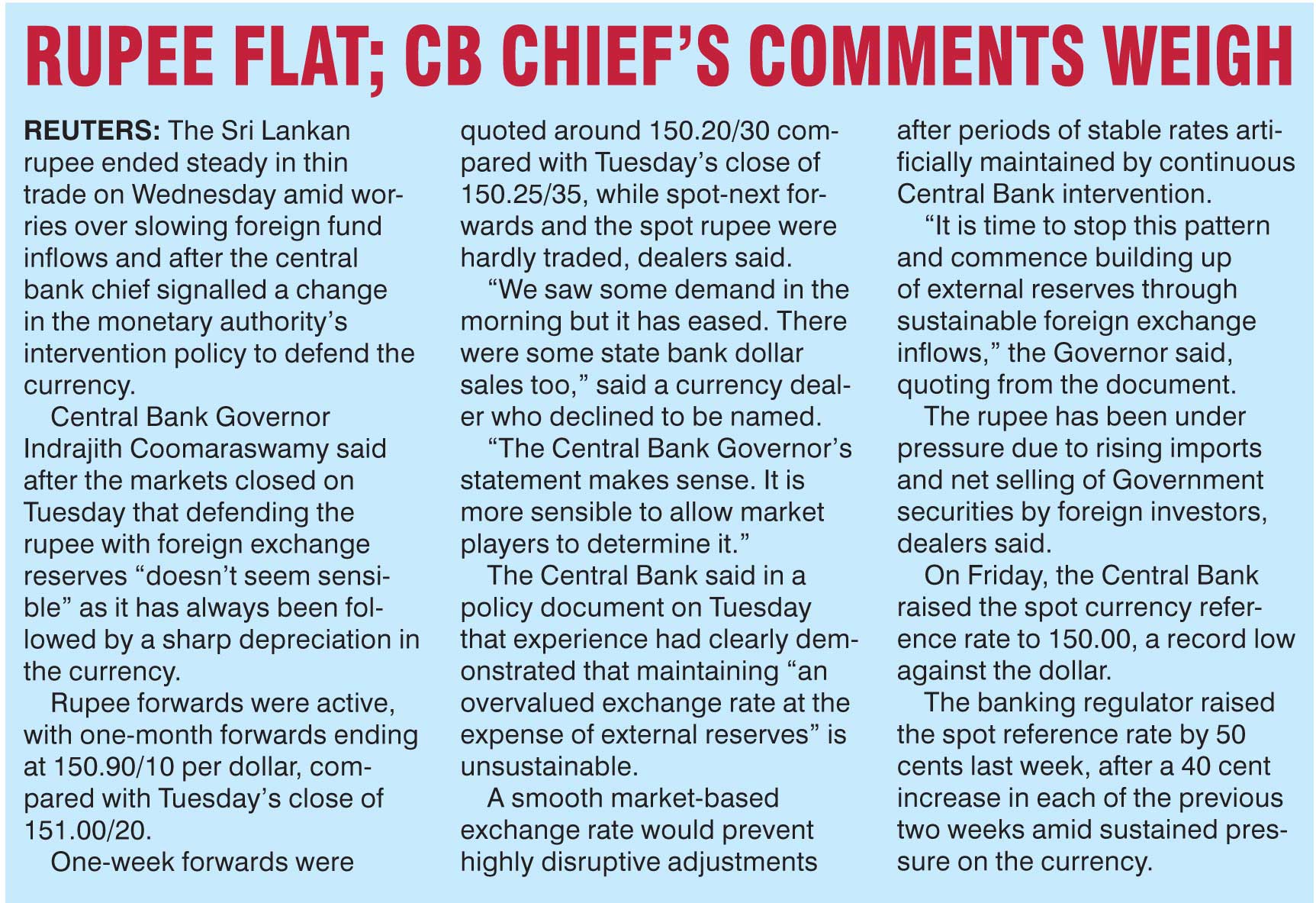

Sri Lanka’s Central Bank Governor on Tuesday signalled less intervention to defend the currency and the market has braced for depreciation in the currency.

The country’s failure to attract foreign direct investment and a lack of investor confidence due to a reversal in some 2016 budget policies weighed on the market and on the rupee, stockbrokers said. The currency lost 3.9% in 2016 and continues weaken.

Turnover stood at Rs. 958.3 million.

Shares in Ceylinco Insurance Plc dropped 18.1% while large cap Ceylon Tobacco Company Plc lost 1.6%.