Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 20 August 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

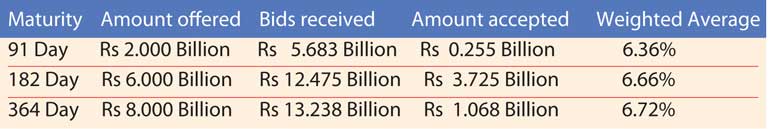

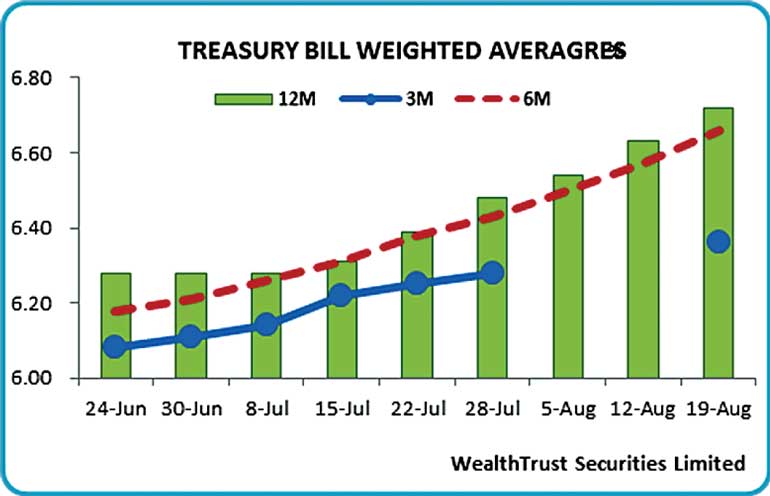

The prevailing upward momentum of yields at the weekly primary T-bill auction, conducted every Wednesday, continued, with the weighted averages of all three maturities increasing to 19-week highs.

Both the 182-day and 364-day maturities, recorded increases of nine basis points each to 6.66% and 6.72% respectively, with the 91-day bill increasing by eight basis points to 6.36%. However, the total accepted volume of Rs. 5.04 billion was the lowest since August 2014.

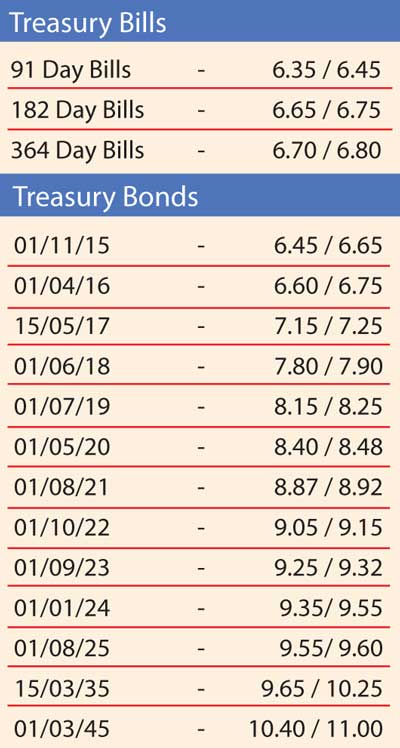

In secondary bonds markets, the liquidity tightness coupled with the primary auction results saw the secondary market bond yields increasing.

The liquid maturities of 01.05.20, 01.08.21, 01.09.23 and 01.08.2025 were seen increasing to intraday highs of 8.42%, 8.88%, 9.25% and 9.55% respectively, as against its previous day’s closing levels of 8.35/40, 8.78/82, 9.17/22 and 9.45/50.

In money markets, the overnight call money and repo rates increased further to average 6.22% and 6.33%, as the net surplus liquidity decreased further to Rs. 35.31 billion. The Standing Lending Facility Rate (SLFR) of 7.50% was accessed for an amount of Rs. 3.25 billion for the second consecutive day.

Rupee appreciates

The volatile pattern in the USD/LKR rate on spot contracts was evident once again, with the rupees appreciating by 10 cents to Rs. 133.90 for the first time in ten days. The total USD/LKR traded volume for the 18 August 2015 was US $ 91.10 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 134.52/62; three months - 135.78/88 and six months - 137.62/72.