Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 27 August 2015 00:00 - - {{hitsCtrl.values.hits}}

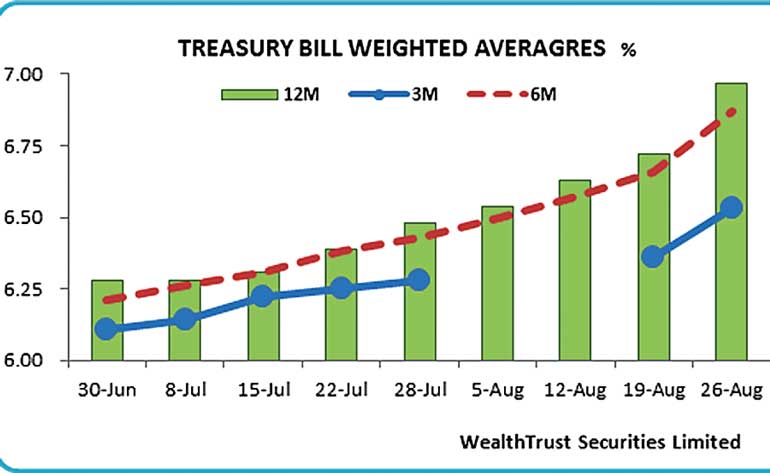

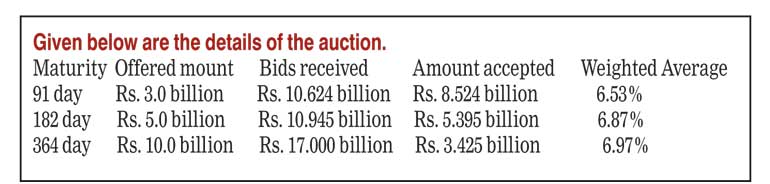

The bearish momentum in primary markets triggered the weighted averages (W. Avgs) at yesterday’s Treasury bill (T. Bill) auction to increase considerably, with the 364-day bill reflecting the sharpest increase by 25 basis points (bp) to a five-month high of 6.97%.

This was closely followed by the 182-day and 91-day bills increasing by 21 and 17 bp respectively to five- and four-month highs of 6.87% and 6.53%. A total amount of Rs. 17.34 billion was accepted against its total offered amount of Rs. 18 billion.

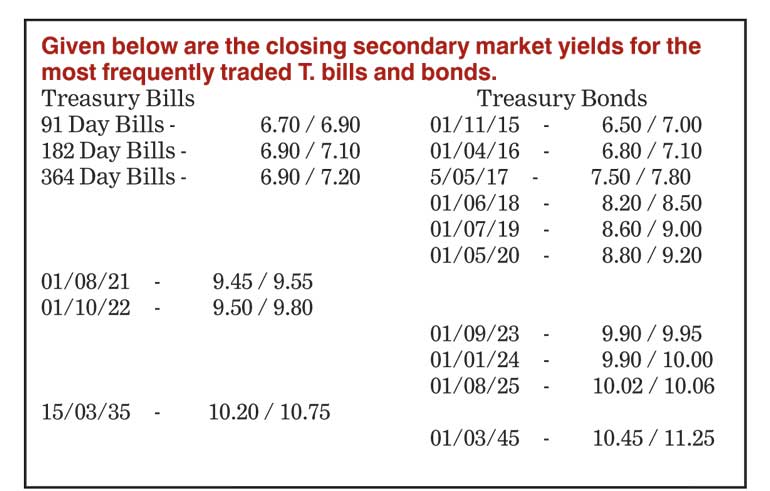

In secondary bond markets yesterday, the upward trend in yields witnessed during the morning hours of trading was accelerated subsequent to the release of the auction results, with the 01.08.2021, 01.09.2023 and 01.08.2025 maturities hitting intraday highs of 9.55%, 9.94% and 10.03% respectively. Meanwhile, in secondary market bills, the 91- and 182-day bills were seen quoted at levels of 6.70/90, 6.90/10 post auction.

Meanwhile in money markets, overnight call money and repo rates decreased marginally to average 6.27% and 6.16% respectively as the Open Market Operations (OMO) department of Central Bank infused an amount of Rs.2.7 Bn yesterday on an overnight basis at a weighted average of 6.15%. The net surplus liquidity in the market stood at Rs.45.22 Bn yesterday.

Rupee appreciates for the first time in five days

In a surprising move, the USD/LKR rates on spot contracts were seen appreciating by 10 cents yesterday to close the day at Rs. 134.15. The total USD/LKR traded volume for 25 August 2015 was $ 93.25 million. Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 134.77/87; 3 Months - 136.03/13 and 6 Months - 137.85/95