Sunday Mar 01, 2026

Sunday Mar 01, 2026

Monday, 21 December 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

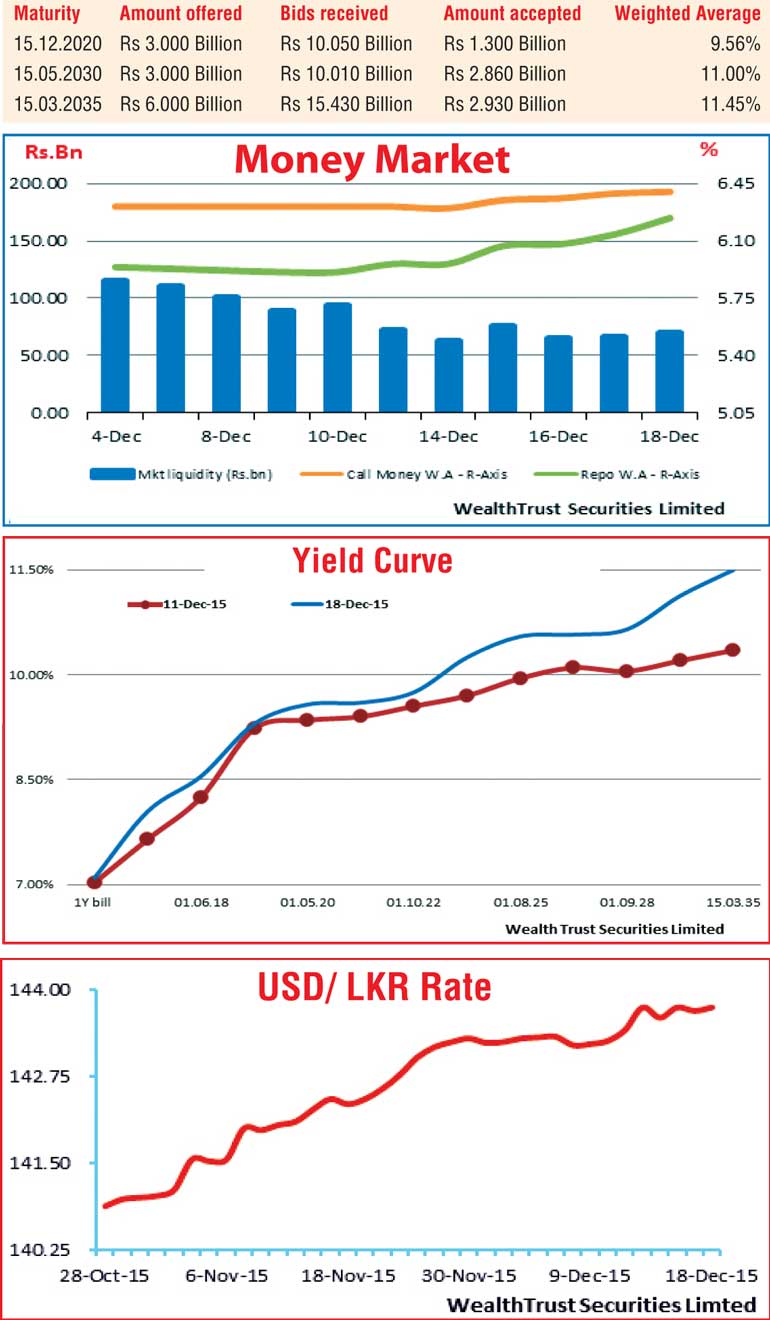

Influential comments on Sri Lanka’s future monetary policy stance, the FOMC (Federal Open Market Committee) decision to increase its rates by 0.25% coupled with considerable increases in primary market rates saw sentiment in the secondary bond market turn negative, creating a buyers’ market environment during the week ending 18 December.

Firstly the weighted average of the 15.03.2035 maturity was seen increasing by 36 basis points at its auction held on Tuesday followed by the weighted averages at the weekly Treasury bill auction increasing further as well across the board. This was closely followed by the weighted averages at the OMO (Open Market Operations) overnight auctions increasing to 6.13% on Thursday.

The increasing trend in primary and secondary markets yields continued during the second round of bond auctions held on Friday as the weighted averages on the 14.05 year maturity of 15.05.2030 and the 19.03 maturity of 15.03.2035 were seen increasing by 67 and 59 basis points respectively to 11.00% and 11.45% against its previous weighted averages.

Furthermore, the weighted average of the newly issued 5.00 year maturity of 15.12.2020 was seen increasing by 65 basis points to 9.56% against a similar maturity auctioned previously with the total accepted amount reducing to Rs. 7.09 billion against its total offered amount of Rs. 12 billion.

In secondary market bonds, the liquid maturities of 01.09.23 and 15.03.35 were seen closing the week at levels of 10.00/50 and 11.30/70 respectively against its previous weeks’ closing levels of 9.60/80 and 10.15/55 as activity came to a standstill during the week.

The overall yield curve reflected a sharp parallel shift upwards for a second consecutive week. This was ahead of the weekly Treasury bill auction due today due to a shortened trading week where a total amount of Rs. 20 billion will be on offer consisting of Rs. 4 billion on the 91-day, Rs. 6 billion on the 182-day and Rs. 10 billion on the 364-day maturities.

Meanwhile, the overnight call money and repo rates increased during the week to average at 6.36% and 6.10% respectively as weighted averages on the overnight auctions conducted by the OMO department of Central Bank increased during the week and surplus liquidity in the money market decreased to average Rs. 68.15 billion for the week against its previous week’s average of Rs. 93.62 billion.

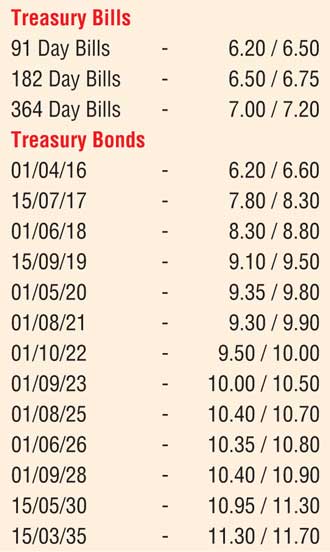

Rupee dips further during the week

The rupee closed the week lower at Rs. 143.70/80 in comparison to its previous week’s closing levels of Rs. 143.35/50 subsequent to hitting an all-time low of Rs. 143.80. The daily USD/LKR average traded volume for the first four days of the week stood at $ 44.40 million.

Some of the forward dollar rates that prevailed in the market were one month - 144.15/30; three months - 145.15/30 and six months - 146.40/60.