Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 13 August 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

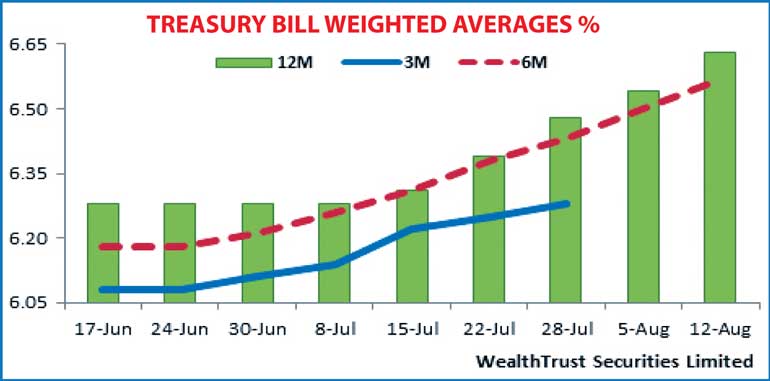

The weighted averages on the 182 day and 364 day bill maturities increased by 07 and 09 basis points respectively to 6.57% and 6.63% at its weekly auction held yesterday to reach levels last seen prior to the policy rate cut of 50 basis points in April 2015. The demand generated for the 182 day bill in the absence of the 91 day bill saw a massive amount of Rs.18.5 billion been accepted against its initial offered amount Rs.8 billion, translating to 84.54% of the total accepted amount.

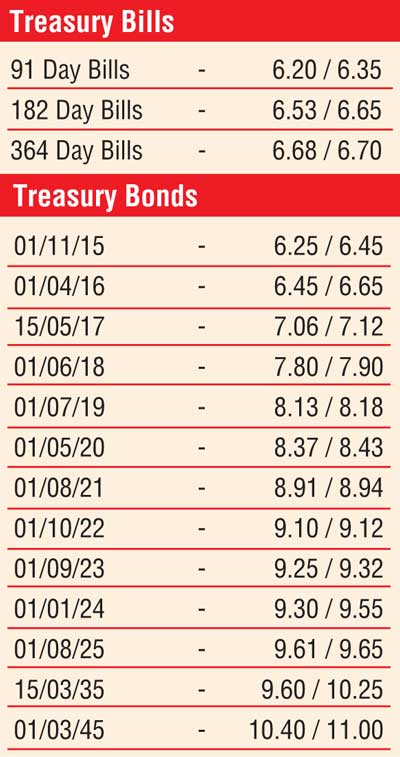

Meanwhile in secondary market bonds, activity was seen drying up drastically yesterday with yields moving up marginally on its two way quotes. A very limited amount of activity was witnessed on the 01.05.2020, 01.10.2022 and 01.08.2025 maturities within the range of 8.38% to 8.40%, 9.10% to 9.13% and 9.60% to 9.64% respectively.

In money markets, the overnight call money and repo rates increased marginally to average 6.11% and 5.90% respectively as surplus liquidity decreased further to Rs.67.11 billion yesterday.

Rupee dips to a three week low

The USD/LKR rate on spot contracts lost ground once gain to hit a three week low of Rs.133.80 yesterday. The total USD/LKR traded volume for the previous day (11-08-15) was US $ 40.20 million. Some of the some forward dollar rates that prevailed in the market were 1 Month - 134.40/50; 3 - Months - 135.45/65 and 6 Months -136.60/90.