Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 15 July 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

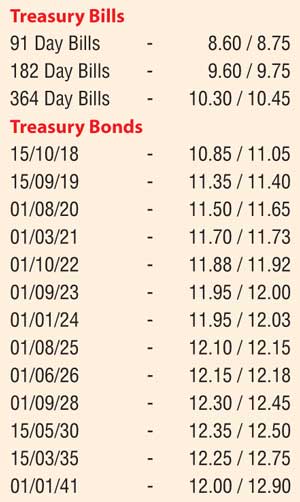

The weighted averages at yesterday’s Treasury bond auctions were seen dipping considerably; well below its previous weighted averages and below market expectations as well, on the back of indirect buying into it. The 4.08 year maturity of 01.03.2021 recorded an average of 11.67% against its previous week’s average of 11.89% while the average on the 9.01 year maturity of 01.08.2025 was at 12.08% against a 7.02 year maturity of 01.09.2023 which recorded an average of 12.19% last week. The weighted average on the 2.03 year maturity of 15.10.2018 stood at 11.04%. All three maturities drew Rs. 20 billion in successful bids against its total offered amount of Rs. 23 billion.

In the secondary bond market, activity remained very high as yields dipped leading to the Treasury bond auctions and following its outcome. The maturities on the belly end of the curve, consisting of 01.10.22, 01.09.23, 01.01.24, the two 2025’s (15.03.25 & 01.08.25) and 01.06.16 were seen dipping to intraday lows of 11.80%, 11.92%, 11.95%, 12.05%, 12.08% and 12.10% respectively against its days opening highs of 11.93%, 12.00%, 12.05%, 12.15% and 12.20% each while on the short end the 15.09.19 and 01.03.21 were seen dipping to lows of 11.38% and 11.70% respectively against its opening highs of 11.42% and 11.80%.

Meanwhile in money markets yesterday, the call money and repo rates remained steady to average at 8.22% and 8.01% respectively as the net deficit stood at Rs. 43.25 billion. The OMO department of Central Bank injected an amount of Rs. 44.36 billion on an overnight basis by way of a reverse repo auction at a weighted average rate of 7.96%.

Rupee closes mostly unchanged

In Forex markets yesterday, the USD/LKR rate on the active one week forward contract was seen closing mostly unchanged at Rs. 146.05/20, subsequent to hitting intraday day high of Rs. 146.10. The Spot next contracts closed at Rs. 145.85/10. The total USD/LKR traded volume for 13 July 2016 was US $ 60.45 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 146.70/00; 3 Months - 148.30/60 and 6 Months - 150.55/85.