Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 23 July 2015 00:00 - - {{hitsCtrl.values.hits}}

Union Bank Director/CEO

Union Bank Director/CEO

Indrajit Wickramasinghe

Union Bank yesterday reported impressive growth in the first half reflecting on the rapid development initiatives the bank embarked post the land mark investment from TPG, the global private investment firm. The rapid transition to a fully-fledged Commercial Bank with wider focus on retail, corporate and SME sectors is evident with the many changes that have impacted to significantly strengthen the bank’s rapidly progressive position.

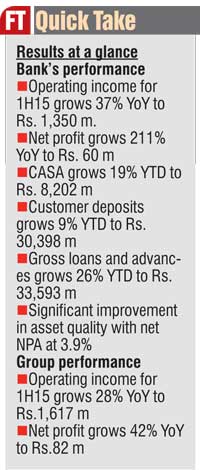

The bank has recorded a significant increase in revenue for 1H15, in comparison to the corresponding period in 2014. Total operating income for 1H15 grew by 37% YoY to Rs. 1,350 m. The primary reason being the strong growth in loans and advances, along with better management of yields and the quality of the loan book.

Net interest income of the bank grew by 43% YoY, to Rs. 1,039 m for 1H15. Fees and Other operating income grew by 21% in comparison to the corresponding reporting period.

The Group recorded a significant increase in revenue for 1H15 in comparison to the corresponding period. Total operating income for 1H15 grew by 28% YoY to Rs. 1,617 m. This is mainly due to the strong net interest income growth of 51%.

Reflecting a significant improvement in the quality of the portfolio, impairment charges of the bank reported a reduction of 43% in comparison to the corresponding period. Correspondingly Group reported a 25% reduction in impairment charges for the period.

In 1H15 operating expenses increased to Rs. 1,109 m. This is a 45% increase in comparison to the previous period. This is mainly due to investments made with regard to customer reach expansion, technology and investments in staff, in keeping with the strategic changes taking place in the Bank. Operating expenses of the group showed a 40% increase due to similar reasons.

The bank reported a profit before tax and financial services VAT of Rs. 135 m for the period. This is a 291% increase in comparison to the previous period. Furthermore the bank reported a net profit after tax of Rs. 60 m for the six months period. This is despite the significant investments that have been made, which are in line with the new strategic initiatives.

The Group reported a profit after tax of Rs. 82 m in comparison to Rs. 58 m in 2014.

Loans and advances of the bank showed a strong growth to report a 28% year to date growth. Loan book stood at Rs. 33,093 m in comparison to Rs. 25,945 m in December 2014. As a result of this total assets of the bank grew by 14% to Rs. 55,825 m.

The strong focus on portfolio quality and improved credit underwriting have resulted in significant improvement in its asset quality, the bank’s net NPA ratio as at June 2015 stood at 3.9% in comparison to 11.8% a year ago.

The customer deposits of the bank increased by 9% YTD to Rs. 30,398 m, whilst CASA reported a stronger growth of 19% YTD.

Total assets of the group reported a 14% YTD increase to Rs. 59,805 m.

The shareholders’ funds of the bank stood at Rs. 16,811 m as at quarter end. The bank is well capitalised as indicated by its regulatory capital adequacy ratio. In 1H15 the bank reported a core capital adequacy ratio of 33.2% and total capital adequacy ratio of 32.6%.

Union Bank Director/CEO Indrajit Wickramasinghe stated: “The first half of 2015 was a crucial period with the bank restructuring itself, and I am pleased to see the results of the many strategic development initiatives and investments gathering a strong growth momentum and its results evident with the performance the bank as highlighted as at June 2015.”

“The growth trajectory that is envisioned will deliver continuous value propositions and benefits to our customers for greater banking convenience. We have ensured greater process efficiencies and aligned our teams to deliver the best value and service. We will continue to deliver on our premise of banking convenience and will also debut several new products shortly,” he added.

The bank said noteworthy upward momentum was highlighted in the expansion initiatives with the branch network reaching to 62 and fast growing ATM network adding 20 new offsite ATMs increasing the network to 83.

In the bank’s mandate to deliver greater banking convenience to customers during the six months ended 30 June, 13 existing branches were remodelled and a new look was unveiled, providing a redefined banking experience to customers.

Widening its focus on the personal banking segment, the bank opened “Elite Circle” a dedicated centre for elite banking services with an elegant ambience, spacious meeting facilities and dedicated relationship managers providing a redefined experience in personalised banking.

Enhancing and adding value to the bank’s product portfolio is an integral part of its development strategy. The bank launched Union Bank Salary Power and Salary Select a competitive savings proposition for professionals. Several savings products were revamped offering increased benefits to customers. The re-launch of personal loans and home loans are key initiatives during the period, which provides customers an opportunity to avail themselves to a wider portfolio of products and services.

An integrated communication campaign was launched as part of the strategy to build stronger corporate brand equity under the concept ‘Make the rest of your life the best of your life with Union Bank’. The campaign has delivered greater brand awareness for the bank and has supported tremendously in its efforts to position it as a fully-fledged Commercial Bank.