Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 11 January 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

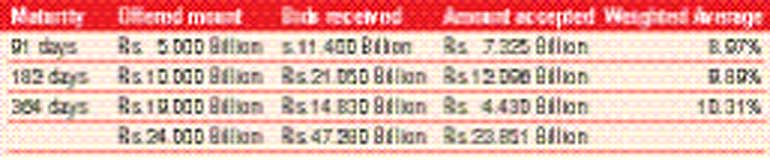

The weighted averages at yesterday’s weekly Treasury bill auction increased for a sixth consecutive week with the total accepted amount just falling short of its total offered amount of Rs. 24 billion by Rs.0.15 billion.

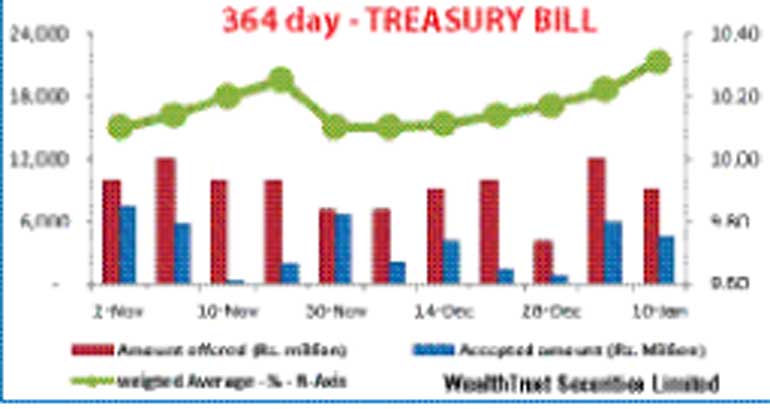

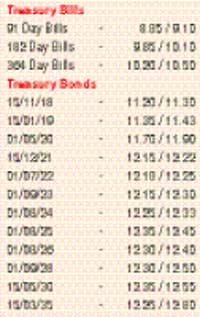

The 91 day bill recorded the sharpest increase by 19 basis points to 8.97% to reflect its highest increase week-on-week since 3 August 2016. The weighted averages of the 182 day and the 364 day maturities increased by 10 and 09 basis points respectively to 9.89% and 10.31% while the 182 day bill continued to dominate the auction as it represented 50.71% of the total accepted amount.

The 91 day bill recorded the sharpest increase by 19 basis points to 8.97% to reflect its highest increase week-on-week since 3 August 2016. The weighted averages of the 182 day and the 364 day maturities increased by 10 and 09 basis points respectively to 9.89% and 10.31% while the 182 day bill continued to dominate the auction as it represented 50.71% of the total accepted amount.

In secondary bond market yesterday, activity moderated as yields were seen increasing marginally on the 01.08.21 01.08.24 and 01.08.26 maturities to intraday highs of 12.18%, 12.30% and 12.34% respectively against its previous day’s closing levels of 12.10/15, 12.20/30 and 12.25/35. In addition, on the short end of the curve, the early 2018s consisting of the 01.02.18 and 01.04.18 maturities were seen changing hands at levels of 10.55% and 10.75% respectively while the 15.11.18 maturity changed hands within the range of 11.20% to 11.30%.

In money markets, The OMO (Open Market Operations) department of the Central Bank was seen mopping up an amount of Rs. 59.15 billion on an overnight basis by way of a repo auction at a weighted average rate of 7.40% as net surplus liquidity increased to Rs. 71.68 billion yesterday. The overnight call money and repo rates averaged 8.24% and 8.58% respectively.

Rupee appreciates further

In Forex markets, the USD/LKR rate on the two-week and one-month forward contracts appreciated further yesterday to close the day at Rs. 150.35/50 and Rs. 150.85/95 against its previous day’s closing levels of Rs. 150.45/60 and Rs. 151.00/20 while one week forward contracts were quoted at Rs. 150.25/35.

The total USD/LKR traded volume for 9 January 2017 was $ 40.86 million.

Some of the forward USD/LKR rates that prevailed in the market were three months - 152.50/65 and sixth months - 154.65/80.