Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 14 March 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The upward trend of weighted averages witnessed at the recent primary auctions, continued at yesterday’s auction as well, with the weighted average yields of the 1.10 year maturity of 15.01.19 and 7.05 year maturity of 01.08.24 increasing by 20 and 25 basis points respectively, to 12.30% and 13.14%.

The volume accepted at the auction of the 15.01.19 maturity stood at Rs. 8.1 billion against its offered amount of Rs. 12.5 billion while the overall volume accepted at the auction stood at Rs. 12.2 billion against its total offered amount of Rs. 20 billion.

Meanwhile, activity in secondary bond markets slowed down considerably, with most market participants remaining on the sidelines. A limited amount of activity was witnessed of the maturities of 01.07.19 and 01.08.24 at levels of 12.60% and 13.18% to 13.20% respectively.

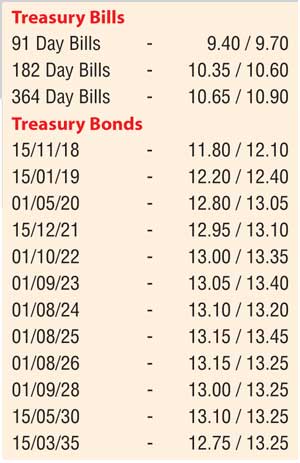

Given below are the closing, secondary market yields of the most frequently traded T-bills and bonds.

In money markets, overnight call money and repo rates averaged 8.50% and 8.58% respectively as the net liquidity shortfall in the system stood at Rs. 25.5 billion. The Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen infusing an amount of Rs. 11.1 billion on an overnight basis at a weighted average of 8.50%. A further amount of Rs. 20.9 billion was accessed via its Standing Lending Facility at a rate of 8.50%, while an amount Rs. 6.5 billion was deposited with the Standing Deposit Facility at a rate of 7.00%.

Rupee depreciates further

The rupee on the active two weeks and one-month forward contracts were seen depreciating further yesterday to close the day at Rs. 152.50/60 and Rs. 153.20/30 respectively against its previous day’s closing of Rs. 152.35/40 and Rs. 153.05/15 on the back of continued importer demand.

The total USD/LKR traded volume for 10 March 2017 was $ 113.32 million.

Given below are some forward USD/LKR rates that prevailed in the market.