Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 24 November 2015 01:02 - - {{hitsCtrl.values.hits}}

Yields increase for a fifth consecutive day

By Wealth Trust Securities

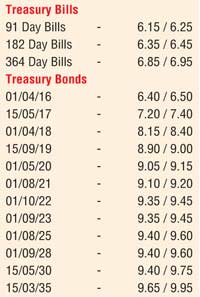

The “wait and see” policy adopted by most market participants ahead of the monetary policy announcement for the month of November 2015 due today at 7p.m., saw activity in secondary bond markets dry up considerably yesterday. Policy rates have remained unchanged at 6.00% and 7.50% respectively on the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) since April 2015. Nevertheless, yields were seen edging up marginally in thin trade yesterday, mainly on the 01.05.2020, 01.08.2021 and 01.10.2022 maturities to hit intraday highs of 9.05%, 9.10% and 9.38% respectively against its Friday’s closing levels of 8.85/95, 8.98/08 and 9.25/35.

Meanwhile today’s weekly Treasury bill auction conducted a day prior due to Wednesday been a Bank holiday, will have on offer a total amount of Rs. 25, consisting of Rs 9. billion on the 182 day and Rs. 16 billion on the 364 day bill. At last week’s auction, the weighted average (WAvg) on the 182 day bill decreased by 37 basis points to 6.50% whiles the WAvg’s on the 364 day decreased by one basis point to 6.93%. The 91 day bill will not be on offer for a third consecutive week.

In money markets, overnight call money and repo rates remained low to average at 6.30% and 5.95% respectively as surplus liquidity stood at high of Rs. 145.97 billion.

The rupee on spot contracts closed the day lower at Rs. 142.70/85 in comparison to its previous day’s closing levels of Rs.142.50/65 on the back of continued importer demand. The total USD/LKR traded volume for 20 November was US $ 98.25 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 143.05/15; three months - 143.85/00 and six months -145.20/30.